Description

List of 3 large German Single Family Offices

Germany is a hotspot for single family offices. In recent years, dozens of major family offices were created. All of them are covered in our unique database. In the following, we are introducing you to three German single family offices from our list.

1. Syngroh Capital (Schiltach, Grohe family)

The Grohe family built up the sanitary product firm Hansgrohe SE since 1901. Today, the firm belongs to the leading companies in the industry with annual revenues exceeding €1.5BN. The family office of the Grohe family invests in different asset classes, amongst others in private equity. Private equity investments of the Grohe family office are pursued through Syngroh Capital GmbH. The focus of Syngroh lies on companies in the German speaking region with an enterprise value between €10-50M. In 2022, Syngroh acquired hob manufacturer TermaCook.

2. Dohle Family Office (Siegburg, Dohle family)

The Dohle family built their family fortune through the well-known HIT trading group, which is one of the largest food retailers in Germany. The company manages 102-HIT stores and employs over 6000 people. The affiliated Dohle Family Office invests on behalf of the family. The investment focus is on real estate and capital investments. There is also an interest in investing in agricultural land.

3. Wirtgen Invest (Neustadt, Wirtgen family)

The German Wirtgen family sold the family company – a construction machinery manufacturer – to John Deere for a billion dollar valuation. In the following, the family established one of the most active German single family offices. Wirtgen Invest is invest in several verticals, from energy, to real estate, venture capital and financial markets. Especially in real estate and renewable energy, the family office plays a major role. For example, several large-scale solar and wind projects were acquired all over Europe. In real estate, the family office already acquired major buildings like the T8 skyscraper in Frankfurt.

Update 2023: In 2022, the Wirtgen family office was once again an active investor. In October, the family investment vehicle acquired the A-Rosa hotel in Sylt, Germany. In December 2022, the firm announced the plan to acquire a 50MW wind park in Greece.

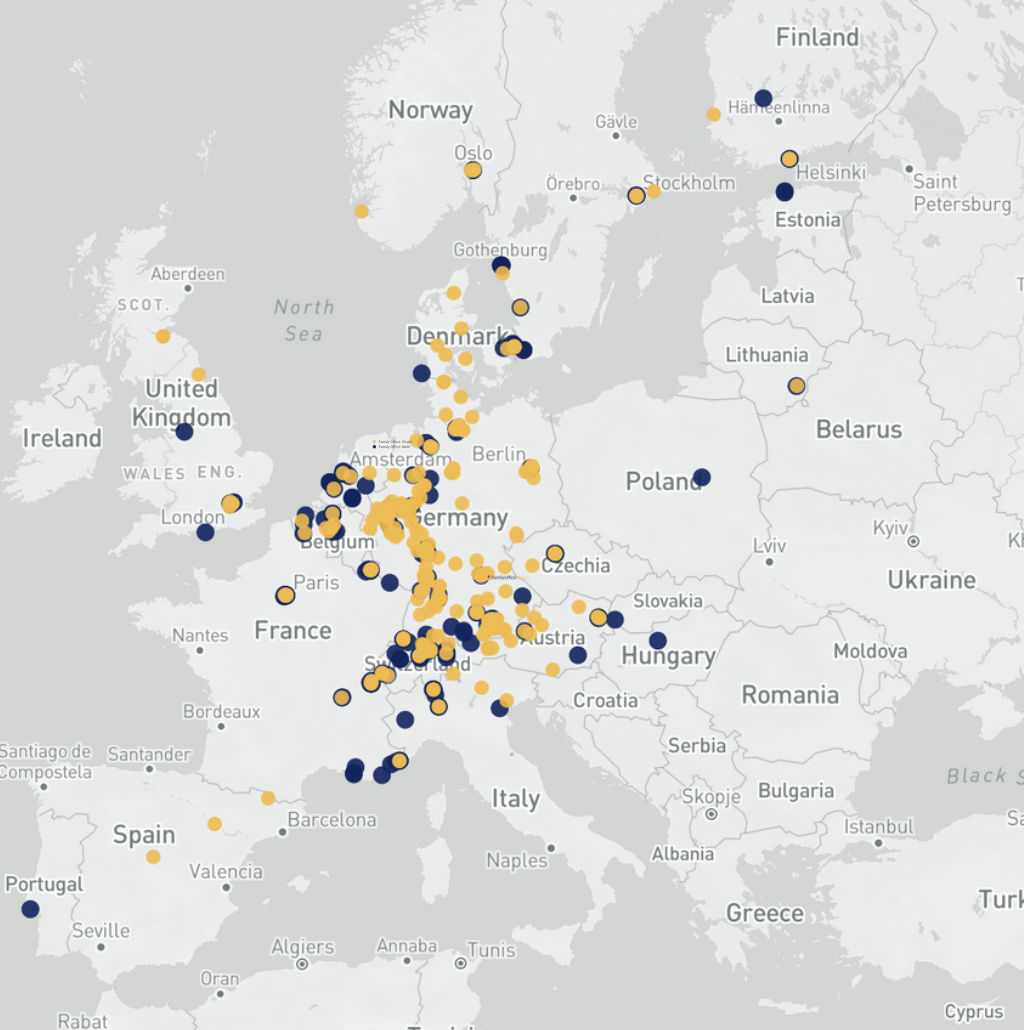

Map of the investors in our list

Germany’s financial centers – with many asset management and investment firms as well as private banks – are Munich, Frankfurt, Berlin and Hamburg. Accordingly, most German family offices are located in these cities. Furthermore, there are a number of highly relevant HNWI investors in Düsseldorf, Stuttgart and Cologne. Of course, there are also many German single family offices that are rather regionally active and anchored, for example in Bavarian small city Rosenheim or Tegernsee.

Private investment vehicles of wealthy German families

Germany’s Single Family Office scene is dominated by entrepreneurial characters whose family built up their family empire within the last century. The SFO wealth is locked in relatively safe assets like real estate or shares of the own family company. But, more and more German SFOs are moving toward alternative investments like private equity or venture capital.

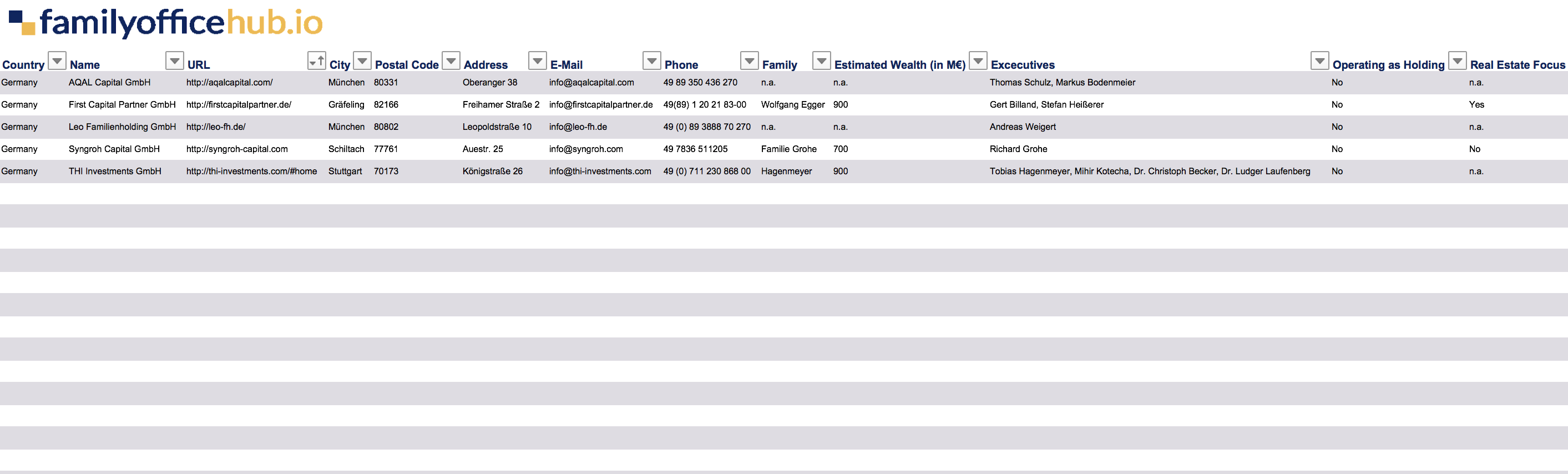

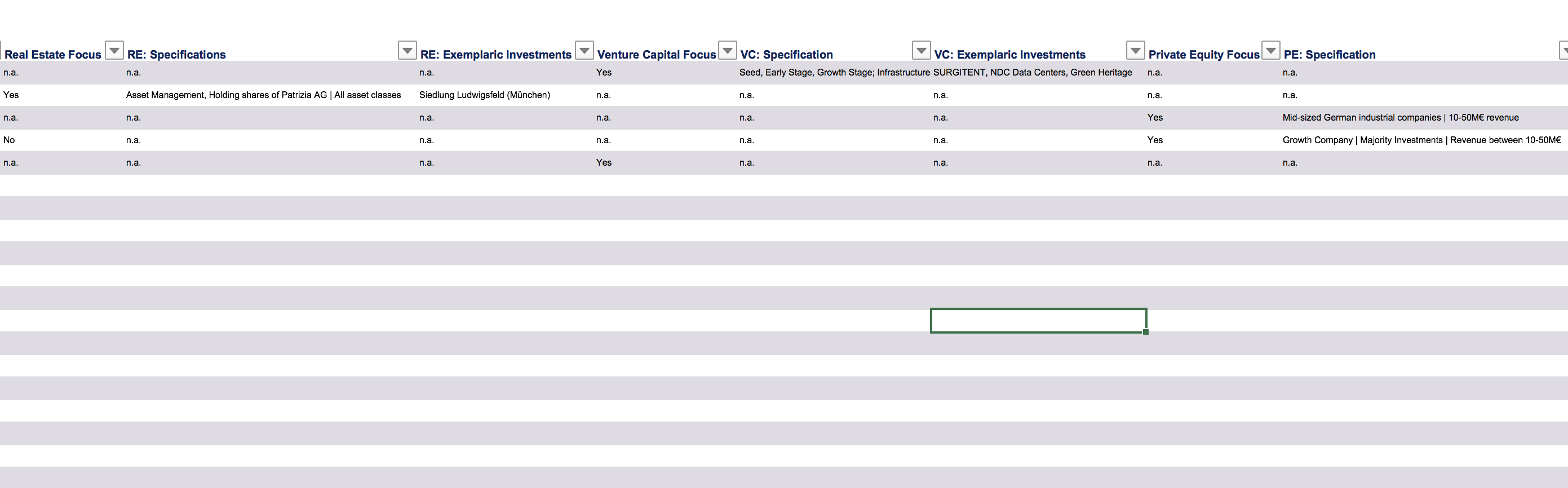

+23 columns of valuable information

We build our lists to ensure optimal usability for our clients. There are three areas included: family information, contact details and investment information. So we provide you with general e-mail addresses, phone numbers, excecutive names, exemplary investments and many more features.

Disclaimer: due to the secrecy of some family offices, we are sometimes not able to provide you with email addresses or other pieces of information. In case we don’t know the exact investment focus, the specific column is marked as n.a.

Download a preview of our database here

We want you to know how our database is structured and what kind of single family offices we list. Therefore, we offer the possibility to download a preview file. Convince yourself how easy it is to download a family office list from familyofficehub.io.

German family offices: a market overview

It is estimated that there are more than 300 (single) family offices in Germany. We cover all of them in our extensive list. In general, there is a broad spectrum of family offices active in Germany. The most basic form of family offices are holding structures that manage the privately-held shares of the family company and extend their focus with dedicated investments. But there are also fully-fledged family investment vehicles, like the Wirtgen family office with investments in capital markets, real estate, venture capital and also alternative asset classes like renewables. Furthermore, there are various specialized German family offices that invest in only one asset class, like venture capital or real estate.

Detailed investment focus, contact details, management, background information

The list contains a large number of data points with which you can work. These begin with basic information such as the name and estimated assets of the family. It also includes, where available, contact details such as e-mail address, website, telephone number and postal address, as well as the names of the managing directors. In order to assess the exact investment focus of the single family offices, we provide data such as detailed information and exemplary made investments for each possible area (e.g. real estate, venture capital, private equity…).

Information included in our list

- Country of main location

- Company name

- Contact data (URL, address, e-mail, telephone number, executives)*

- Family information (Name, Estimated family assets in M€, Holding structure)*

- Real Estate Focus (Yes/No) / Real Estate Focus Details / Example Real Estate Investments

- Venture Capital Focus (Yes/No) / Details on Venture Capital Focus / Examples of Venture Capital Investments

- Private Equity Focus (Yes/No) / Details on Private Equity Focus / Examples of Private Equity Investments

- Financial assets focus (Yes/No)

- Renewable Energies Focus (Yes/No)

- Other focus (art, forest and agricultural areas, etc.)

- Creation and final review of Excel entries

*Values may be missing if some data points are not publicly available. The “largest single family offices” are defined by the wealthiest German families who actively invest through companies and for whom reliable information is available. By regular, free updates and extensions we constantly improve the quality of the information. We will be happy to provide you with more detailed information.

Our service: free preview file before the purchase, free updates after the purchase

With Familyofficehub, the customer always comes first. Should you have open questions or individual wishes, you are welcome to contact us at any time by live chat, e-mail or telephone. In order to convince yourself of the data quality and the included data categories you can receive a free preview file before the purchase. After the purchase we offer our customers free updates and extensions within one year. The Single Family Office list has grown from 50 entries (2017) to over 200 entries (July 2019).

Types: from holding structures to professional investment firms

As a leading market research company in the German family office market, we can divide the German single family offices into three groups. Some of the family investment companies are organized in a holding structure. These are often built around the family business. The assets are only partially invested in financial products and external investments. The largest part of the assets is concentrated on the own company and its well-being. The exact opposite of this is the Single Family Offices as investment companies: in these, the family business or own company was often sold and now the money is invested in various asset classes and financial products. There are also small, specialized single family offices that are run by only a few employees or family members. The investment focus is often close to the traditional business: real estate, private equity, venture capital and financial investments.

Real estate as major asset class

Real estate is one of the most common asset classes in German single family office portfolios. Some SFOs draw their wealth from family-owned real estate, while others continuously build up their real estate holdings. Family Offices see real estate as an important part of their portfolio, as it offers two important advantages: quite a high stability of value and steady distributions. This fits in well with the investment objective of single family offices – to preserve family assets and generate steady distributions for family members. How family offices invest in real estate differs greatly. Some SFOs buy up existing buildings in the residential, office and retail sectors, while others are even active as project developers. Smaller family offices or those without real estate experience often rely on external fund managers or co-investments. If only the real estate focused single family offices are relevant for you, you will find the appropriate focus list here.

The role of equities, bonds and financial products for German family investment vehicles

In addition to real estate, equities and bonds are also asset classes that are frequently used by family offices. The characteristics and investment profiles are fundamentally different. Numerous single family offices have a great deal of in-house expertise in the financial markets and manage their portfolios independently. Some SFOs even offer their research services and funds to external investors. Other SFOs rely on funds, ETFs and asset managers to select their financial products.

German family funds investing in venture capital and private equity

Real estate, bonds and equities are often the safer investment products in family office portfolios. On the other hand, the returns to be achieved are also lower. Investments in venture capital and private equity are different: here, high returns are tempting but also come with a higher risk. Especially in due to the low interests, German single family offices are increasingly turning to these two asset classes. Venture capital investments are made in start-ups of various sizes and sectors. Private equity investors invest their money in unlisted companies. Frequently, investments are made in the area of family businesses or single family office expertise: Internet founders invest in Internet companies, medium-sized family office holdings participate as strategic private equity investors. Some of the SFOs included in our list are also exclusively active in the venture capital or private equity sector.

In order to get a feeling for the Single Family Offices included, we present selected entries in more detail below. We will go into the background and the respective investment focus in more detail.

David A. Pieper, Optimus Prime Group –

Familyofficehub offers interesting and relevant data, always up to date. Checkout and customer support works smoothly. A clear recommendation on my part!

Dr. Oliver Wilhelm, 21st Real Estate GmbH –

A very helpful tool to detect the acquisition potential of a self-contained and demanding clientele. Great personal support. Continue that way.