Description

List of 3 large German multi family offices

Germany is Europe’s strongest economy. Consequently, there is a huge amount of entrepreneurial money to be invested and managed. Besides more than 300 German single family offices, there are also more than 100 major multi family offices. Thereof, we introduce you to three interesting firms.

1. HQ Trust (Bad Homburg v.d.H.)

The German family of Harald Quandt accumulated a massive amount of wealth in the years after the second world war. From 1973 on, the family started to divest its industrial assets. In 1981, the Harald Quandt Holding was established a a single family office, which in turn was opened to other families in 1988 as multi family office. HQ Trust in its form today was established in 2006, being today a leading multi family office. The family office is active in traditional asset classes like equity and funds as well as alternative investments like private debt, real estate, private equity and hedge funds.

Update 2023: In February 2023, the German multi family office HQ Trust announced the opening of another office location in Berlin. The new location will be especially targeted at successful startup founders.

2. Focam AG (Frankfurt)

Another renowned multi family office in Germany is the Frankfurt-based Focam AG. The family office, led by Christian Freiherr von Bechtolsheim, was established in 1999. It’s active in Asset Management and mainly invests through trusted third-party managers. The services of FOCAM range from tactical asset allocation to investment research and reporting tasks. The firm calls itself “Trusted Advisor” – and has managed to win mandates of dozens of entrepreneurial families throughout the years.

3. Pamera Real Estate Partners (Munich)

A different approach for wealthy German families is offered by Pamera: the Munich-based firm acts as a real estate multi family office. For its clients, Pamera builds up real estate portfolios consisting of residential, office, hotel and retail properties. Furthermore, Pamera is active in real estate development and mezzanine capital. So far, Pamera is managing more than 40 properties and €850 million of assets. The track record of the German real estate investor exceeds €1.4 billion.

Update 2023:Pamera announced that it increased during 2022 its assets under management to €1.5BN. Thereby, the German real estate multi family office increased its assets by 25% YoY.

Picture source: Matteo Krössler

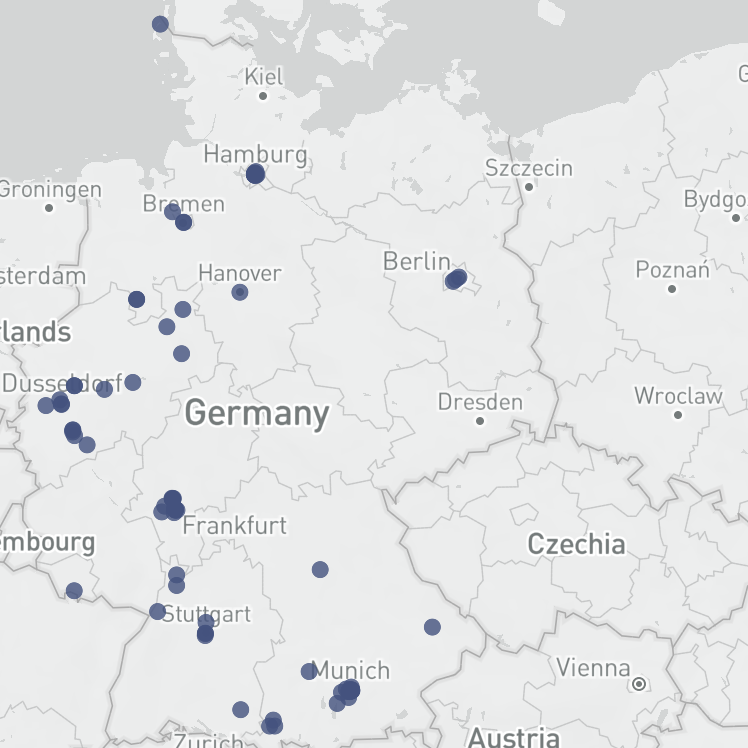

Location of German Multi Family Offices

Most german multi single family offices are located in the cities Frankfurt, Hamburg, and Munich. This is due to the fact that Hamburg and Munich are two of the largest cities in Germany and Frankfurt is known as the financial center of Germany and even one of the largest financial hubs in Europe. However it cannot be forgotten that cities like Berlin and Stuttgart also do have multiple Multi Family Offices. This is because in Stuttgart as well as Berlin has large industrial and service companies.

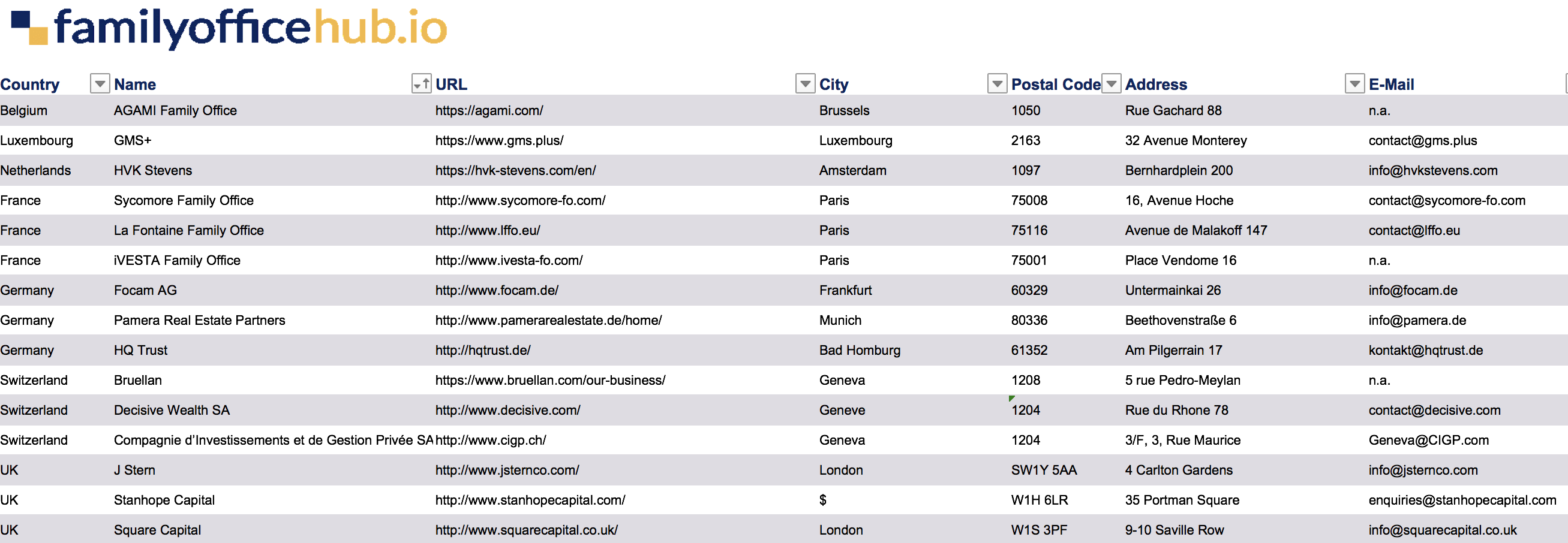

German Family Wealth Management Firms

In Germany, multi family offices are playing a vital role in the country’s asset management landscape. Many wealthy entrepreneurial families are relying on multi family offices, which are pooling the assets of multiple families. Investments are done through external asset manager, own funds or alternative investments.

+17 columns of valuable information

We build our lists to ensure optimal usability for our clients. There are three areas included: family office information, contact details and investment information. So we provide you with general e-mail addresses, phone numbers, excecutive names, type of family office (asset management / consulting / bank affiliated).

Interested, but you want to know more? Get a preview file with exemplary entries.

You can directly download a preview file at the multi family office list preview product page. In case of any remaining questions or if you want an individual preview file drop us a line via email or live chat.

R.S. (verified owner) –

The list brought us many extremely useful leads. Thanks for the update as well.