Description

List of 5 large Asian Multi Family Offices

In the following, we are introducing you to five exciting Asian multi family offices from our directory. We are covering their focus, their history and key points.

1. Maitri Asset Management (Singapore)

Originally, Maitri was founded in 2015 as Tolaram family office. Today, the family office is one of the most important multi family offices in Asia. The firm is awarded as Best ESG Manager in Singapore and active in many other sustainable action initiatives. Furthermore, twenty-five percent of Maitri’s earnings go to the Ishk Tolaram foundation.

2. Blueprint Forest (Bangkok, Thailand)

Bangkok-based family office Blueprint forest is a major family investment firm in Southeast asia. In 2020, the firm announced the launch of a $120M fund that invests in businesses across Southeast Asia. The core values of Blueprint are “ownership”, “trust”, “learning”, “rationality”, “unity” and “positivity”. In 2021, Blueprint invested in Singapore based DeFi-based bug bounty platform Immunefi.

3. Alto Partners (Singapore)

Alto Partners is one of the most important multi family offices in Singapore and Asia. The firm says about itself that it is a family office “by and for Asia’s leading entrepreneurs and next-generation investors”. Indeed, the family office is an active investor in venture capital, financial markets and real estate. For example, the company invested in stashfin, Snapchat, canopy and Grab.

Update 2023: The Asian multi family office Alto Partners remains an active startup investor. In February 2023, the firm announced that it participates in the $27M funding round of fintech startup Shift, which is led by Sequoia Capital Southeast Asia.

4. Capital A Ventures (Bangkok, Thailand)

The history of Capital A Ventures from Bangkok follows a pattern that is common in Europe. Originally, the firm acted as family office of the Dheva-Aksorn family. Now, it is open for other families that are looking for a professional, entrepreneurially-led multi family office. The family office takes care of investment management, tax planning, estate planning, philanthropy, risk management and personal topics.

5. TCK (Seoul, South Korea)

Another well-known Asian MFO is TCK. The firm was founded by Ohad Topor and has offices in Seoul and London. TCK is investing globally with a long-term approach. Furthermore, the important family office operates with a multi-asset approach. Howard Marks, chairman and founder of asset management giant Oaktree Capital, acts as Senior Advisor for TCK.

Picture source: Peter Nguyen, Unsplash

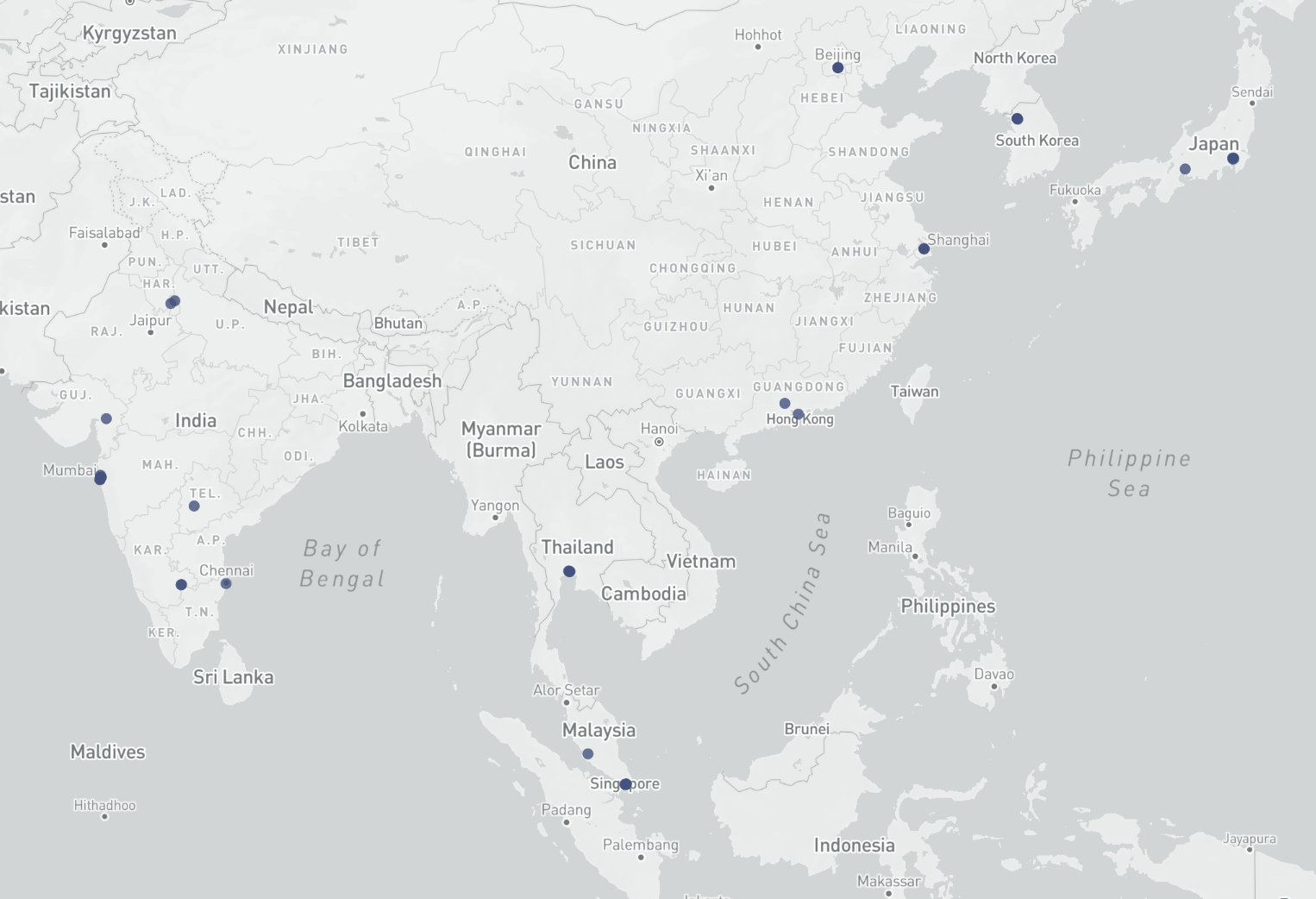

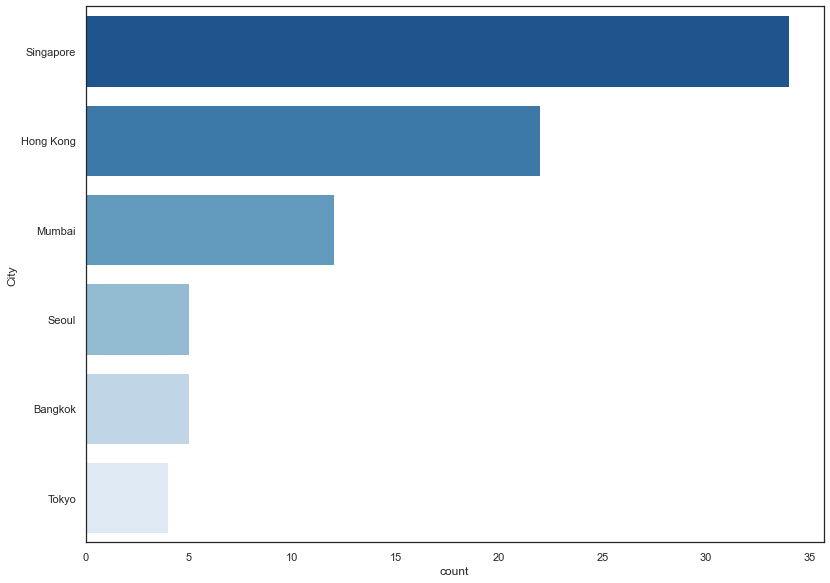

Locations of Asian family offices

Asia’s most important multi family office investors are spread throughout the continent. Major financial centers for family offices are Singapore, Mumbai and Hong Kong. Further important hotspots are New Delhi, Peking and Bangkok.

Spotlight on Asia’s HNWI wealth management industry

While family offices are already established in European and American markets, they are still a relatively new phenomenon in Asia. Many family offices in Japan first have to explain the concept to their customers, for instance. However, there are various Asian family office investors today that already play an essential role in Asian and global financial markets.

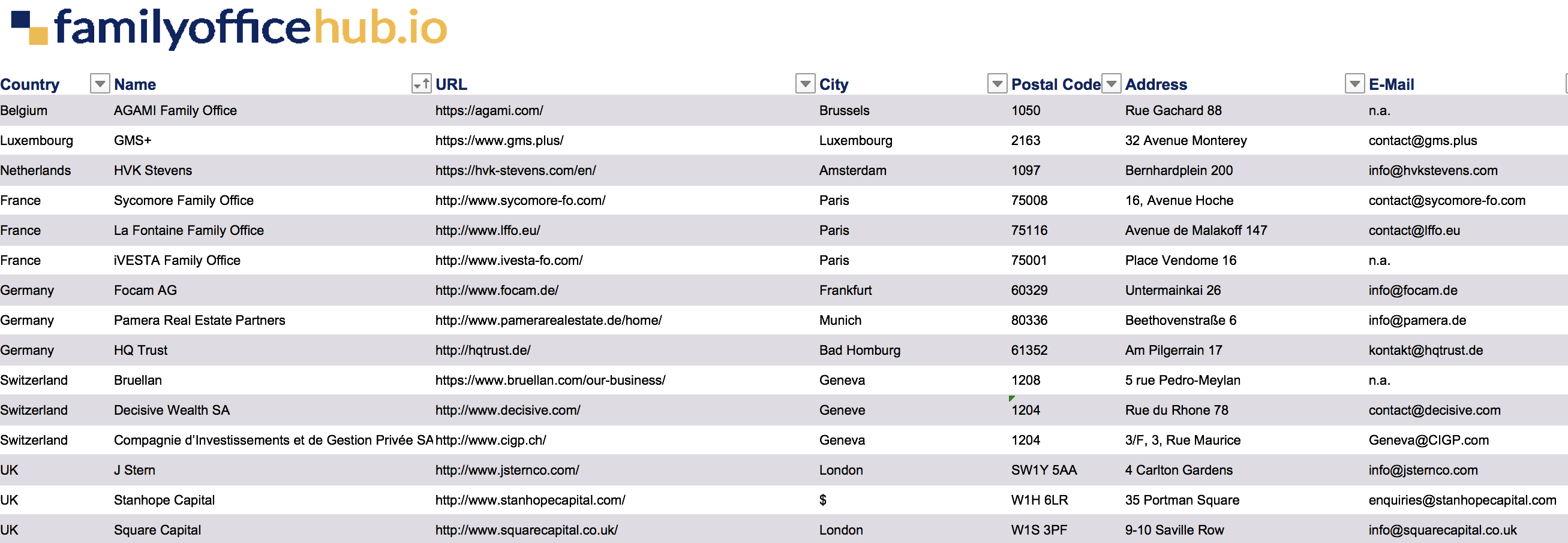

+17 columns of valuable information

We build our lists to ensure optimal usability for our clients. There are three areas included: family office information, contact details and investment information. So we provide you with general e-mail addresses, phone numbers, excecutive names, LinkedIn profiles of executives, type of family office (asset management / consulting / bank affiliated).

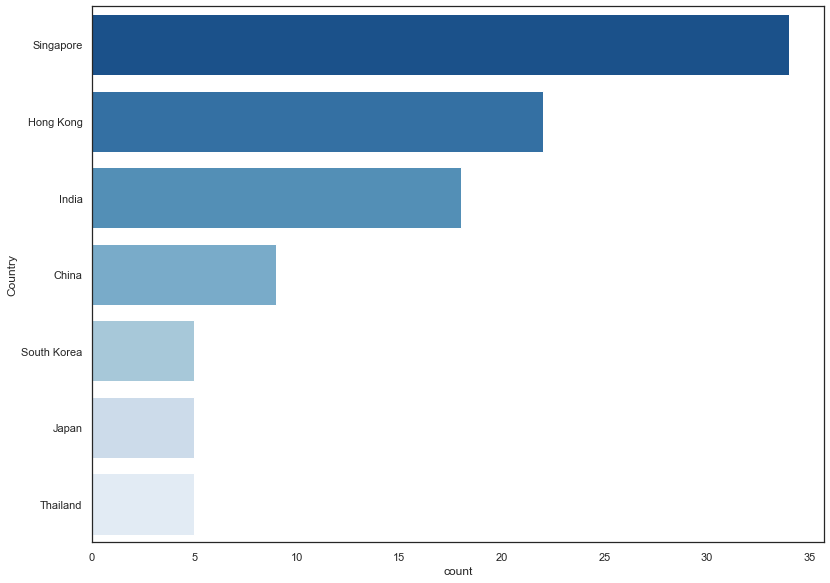

Country of origin

Most multi family offices in our list are based in Singapore with 34 MFO’s. This is no surprise as Singapore is Asia’s most important banking center. Singapore is followed by Hong Kong with 22 family offices, India with 18 MFO’s, and China with nine multi family offices.

Reviews

There are no reviews yet.