Description

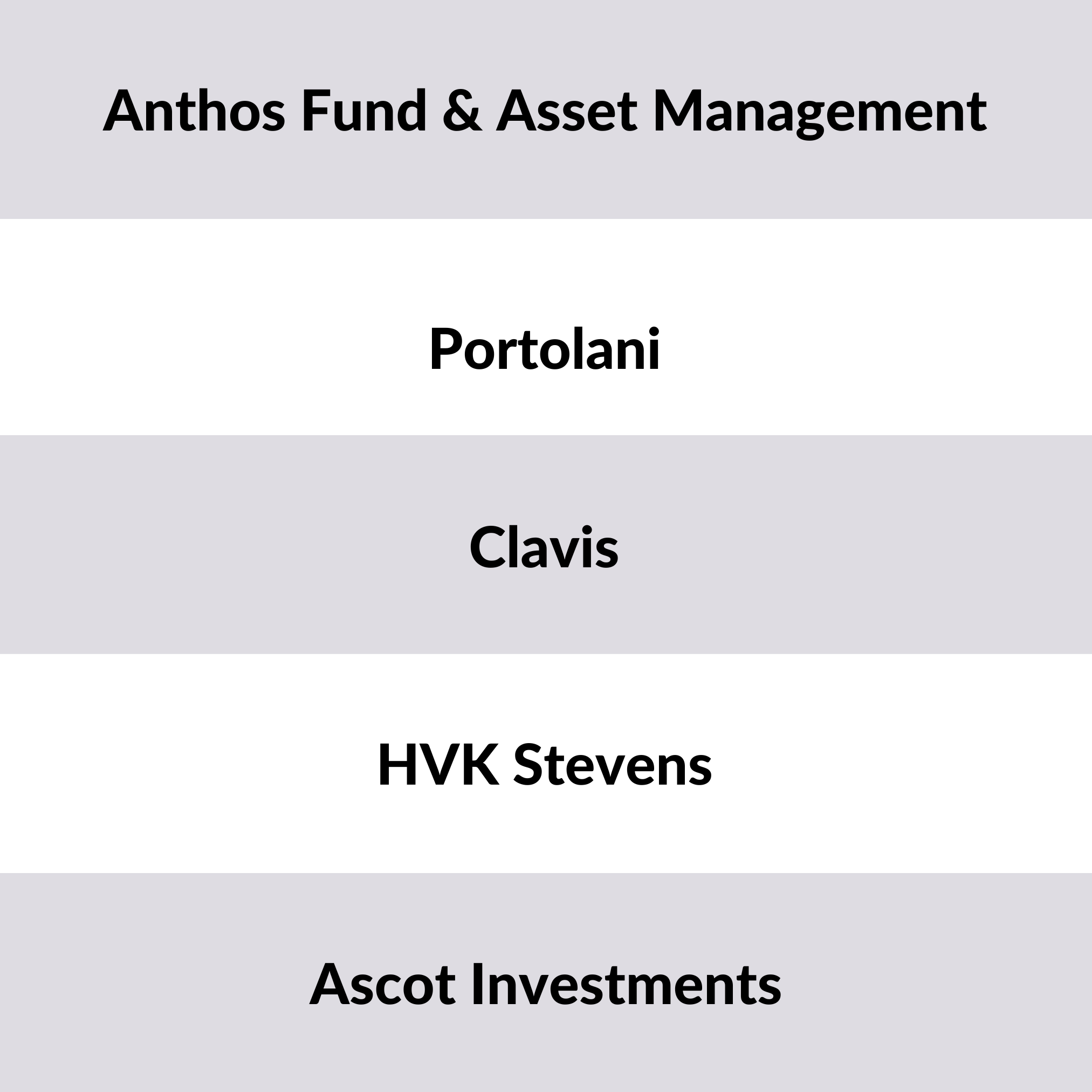

List of 3 large Benelux multi family offices

The Benelux region is home to many important European multi family offices. In the following, we are introducing you to three interesting family investment firms from the region.

1. Anthos Fund & Asset Management (Netherlands)

Anthos started as the asset management arm for the Dutch Brenninkmeijer single family office, investing in equities, fixed income and real estate. Since 2010, the family office is also investing in private equity. Over recent years, the family office opened up for third-party family offices, now acting as multi family office, offering a broad portfolio of services and investment strategies for their clients.

2. Portolani (Belgium)

The Belgian multi family office Portolani takes separates its services in the sectors “portfolio construction and monitoring”, “corporate finance advice” and “family governance and wealth structuring”. The family office manages the wealth of two dozen wealthy families and was launched in 2006. Portolani works together with managers of liquid funds and illiquid funds, focused on private equity, real estate, private debt and infrastructure.

3. Clavis (Netherlands)

The Dutch multi family office Clavis was launched in 2008. In its asset management division, the family office invests in financial markets, e.g. in bonds and alternative investments. Furthermore, Clavis pursues private market investments, for instance in private equity, real estate and debt. For wealthy families, Clavis offers a wide range of family office services.

Picture source: Micheile Henderson

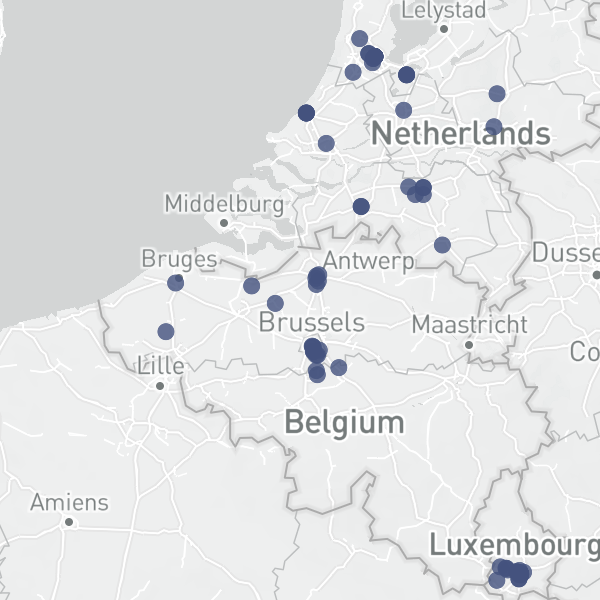

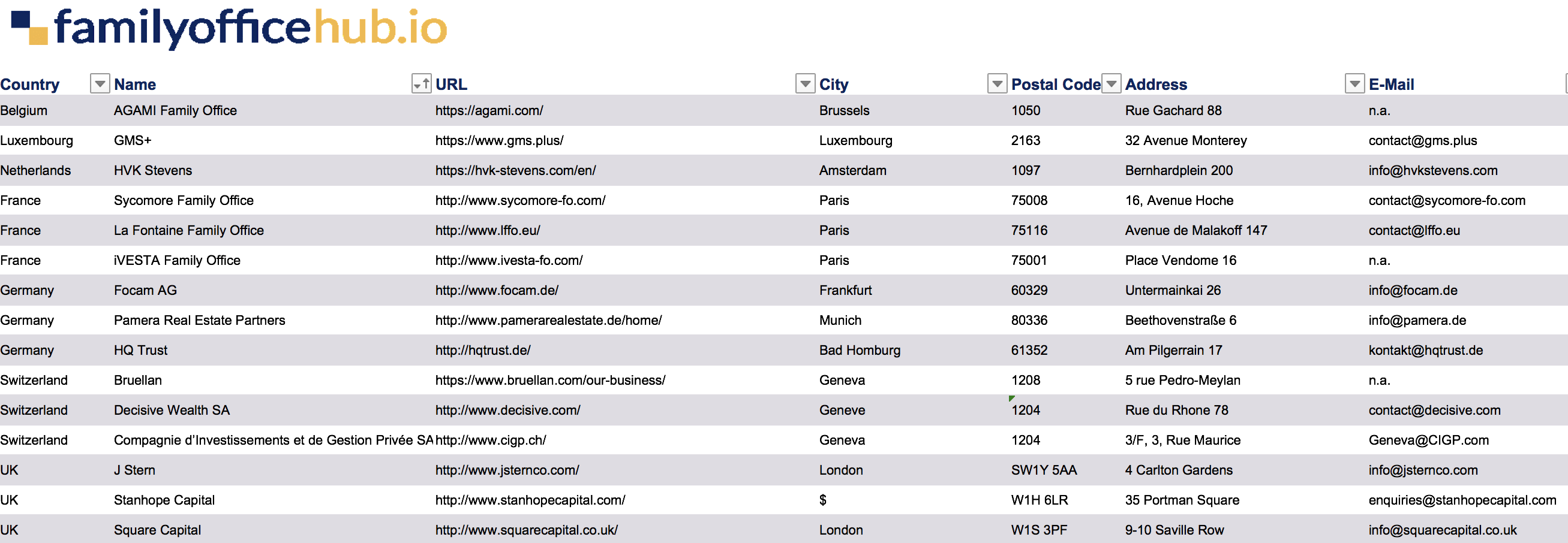

Location of Benelux multi family offices

Multi family offices in the Benelux Union are often located in each countries capital. In the Netherlands most multi family offices are based in Amsterdam, in Belgium they are based in Brussels and in Luxembourg most are based in Luxembourg city.

Benelux Multi Family Offices

The Benelux area consists of Belgium, the Netherlands and Luxembourg. All of those countries are important financial hubs in Europe. Many wealthy entrepreneurial families are relying on multi family offices, which are pooling the assets of multiple families. Investments are done through external asset manager, own funds or alternative investments.

+17 columns of valuable information

We build our lists to ensure optimal usability for our clients. There are three areas included: family office information, contact details and investment information. So we provide you with general e-mail addresses, phone numbers, excecutive names, type of family office (asset management / consulting / bank affiliated).

Interested, but you want more? Get a preview file with exemplary entries.

You can directly download a preview file at the multi family office list preview product page. In case of any remaining questions or if you want an individual preview file drop us a line via email or live chat.

Francois Valon (verified owner) –

top data quality, really useful list, mostly info@ emails, but this was to be expected

Alain MERGOT (verified owner) –

Très bon, merci