Description

List of 3 large Multi Family Offices from Switzerland

Switzerland is one of the most important countries in Europe’s multi family office landscape. In the environment of dozens of wealth managers and private banks and billions of capital to be invested, family offices are thriving. We are introducing you to three major Swiss multi family offices from our database.

1. UBS (Zurich)

UBS is one of Europe’s largest banks and asset managers with more than USD 1.1 trillion of invested assets. The family office positions itself as one-stop-shop for its wealthy family clients. It offers investment solutions as well as private investments in private equity and real estate.

2. 1875 Finance (Geneva)

The multi family office 1875 finance has its roots in the banking family Ormond, who is active in wealth management for multiple generations. The firm manages more than CHF 11 billion of assets and employs 65 people. Besides for high net worth families, 1875 offers its services to private individuals and institutional clients. 1875 Finance has offices in Geneva, Zurich, Luxembourg and Hong Kong.

3. Marcuard (Zurich)

Another well known Swiss multi family office is the Marcuard Family Office AG. The firm was founded in 1998 in Zurich. Its servies range from asset consolidation and reporting to risk analysis and fee negotiations. Besides, the firm helps to establish single family office and to execute family investment strategies.

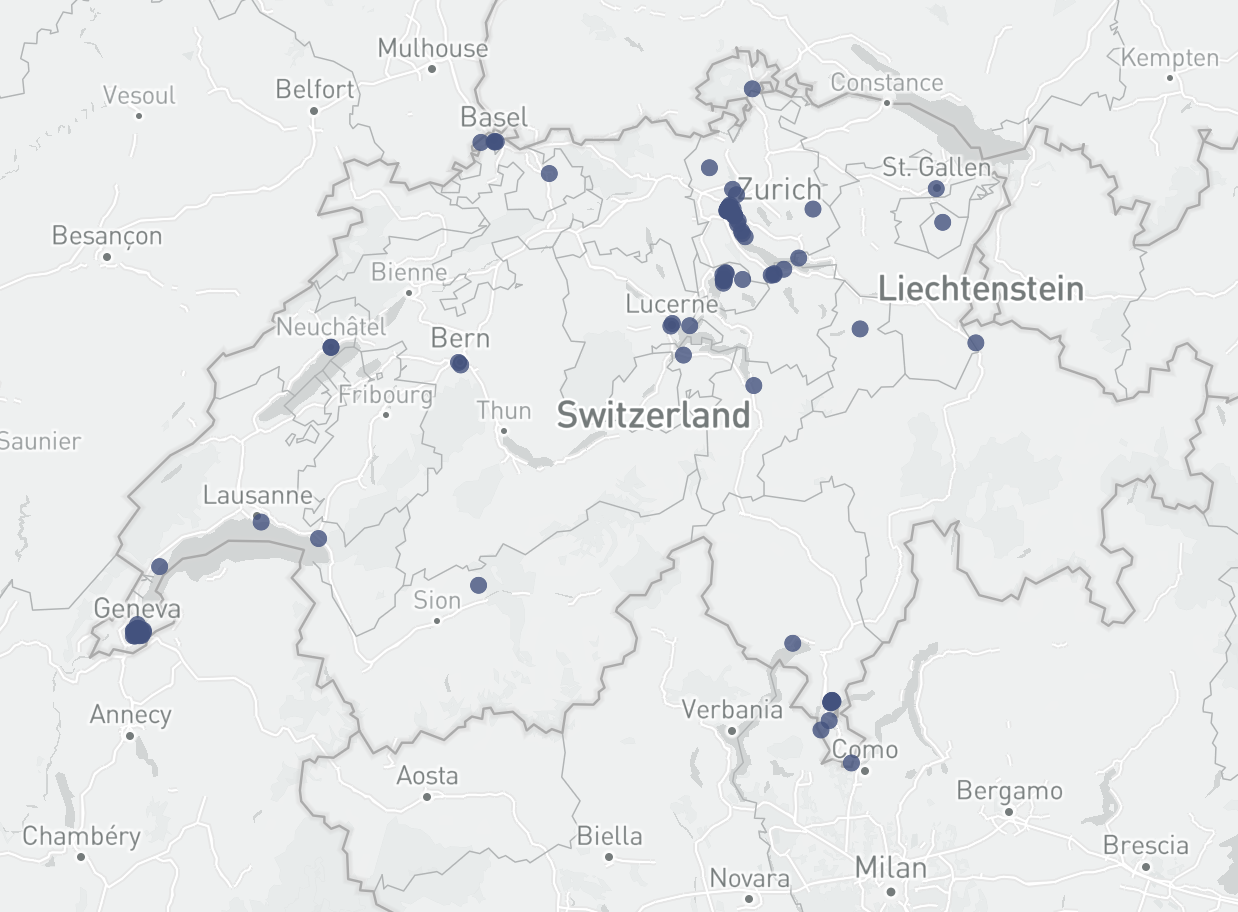

Location of Swiss Multi Family Offices

Switzerland is a country with a high GDP and many HNWI. Multi Family Offices are all over the country. They are commonly found in larger cities like Bern, Lucern and Basel. However the largest accumulation of Multi Family Offices can be found in the cities Zurich and Geneva. This is no surprise since these two cities are the main financial and economic hubs of Switzerland.

Switzerland’s HNWI investment industry

Many wealthy entrepreneurial families are relying on multi family offices, which are pooling the assets of multiple families. Investments are done through external asset manager, own funds or alternative investments. Main multi family office hubs in Switzerland are Geneva (with 52 MFOs) and Zurich (with 56 MFOs). Thereby, Zurich is the city with the most multi family offices in Europe.

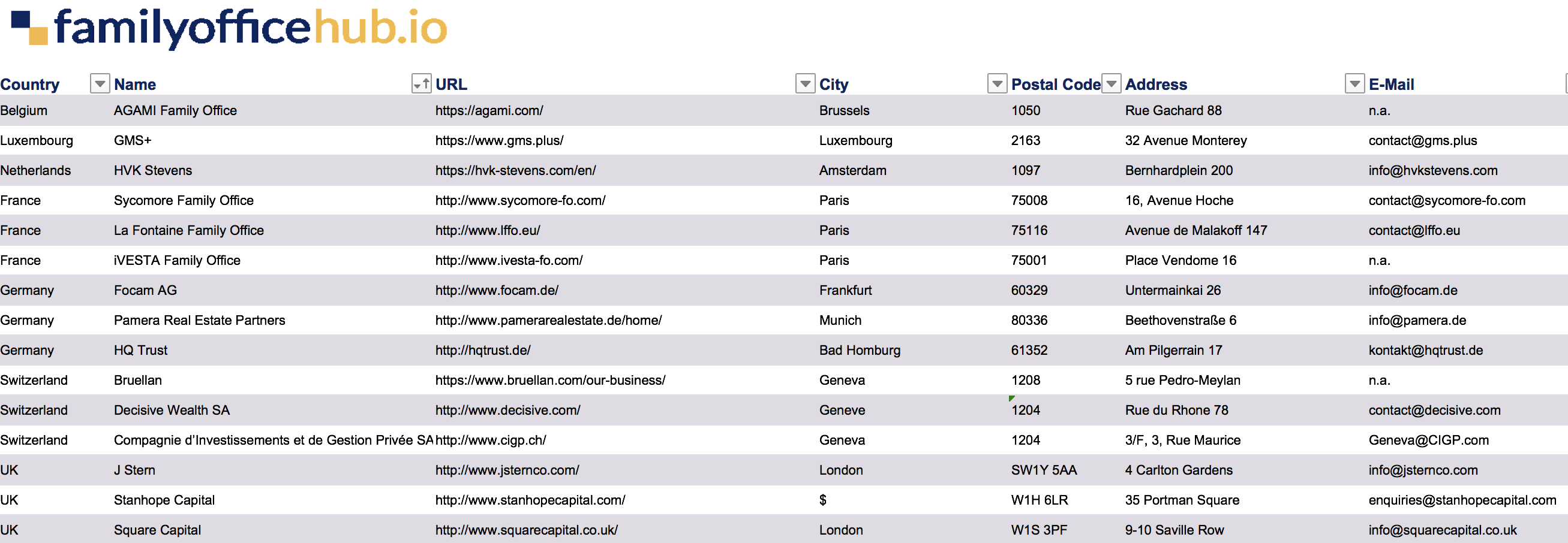

+17 columns of valuable information

We build our lists to ensure optimal usability for our clients. There are three areas included: family office information, contact details and investment information. So we provide you with general e-mail addresses, phone numbers, excecutive names, type of family office (asset management / consulting / bank affiliated).

Interested, but you want to know more? Get a preview file with exemplary entries.

You can directly download a preview file at the multi family office list preview product page. In case of any remaining questions or if you want an individual preview file drop us a line via email or live chat.

Segmentation according to corporate focus: asset management, consulting, banking-related services

In order to be able to identify the appropriate Multi Family Offices immediately, we have included a column with the focus of the respective companies. The focus is divided by Asset Management, Consulting and Bank-Related Services. By asset management we mean active asset management on behalf of wealthy clients. These multi-family offices manage part of their partners’ assets directly and invest money on the capital market, acquire real estate, carry out private equity deals, invest in funds or exploit other investment opportunities. MFOs active in consulting offer a variety of advisory services. The advice can be related to asset structuring by helping HNWIs to make the right investment, according to their needs. However, consulting can also be much broader in scope, covering topics such as concierge services, legal advice, yacht management, a personalised CFO, M&A consulting, succession planning or managing and buying of art. The third category, “banking-related services”, is awarded to family offices that are part of a bank or initiated by a bank. Swiss private banks in particular have increasingly focused on HNWIs and wealthy families in recent years and offer their own multi-family offices.

Information included in the overview of the most relevant MFOs from Switzerland

- Contact details (address; telephone number; e-mail address; management board)

- Subdivision by focus (asset management; consulting in asset structuring; bank-related services)

- Additional focus of MFOs, if applicable (real estate; private equity; yacht management etc.)

Zurich, Geneva, Lugano, Basel and Co.: hotspots for Swiss family offices

Hardly any other country is as renowned for successful asset management as Switzerland. The country is home not only to numerous private banks and asset management companies, but also to many multi-family offices. Particularly relevant locations are Zurich and Geneva, but our database covers many other cities and provides a comprehensive picture of the Swiss MFO market. Thanks to its extensive experience in market research, the team of familyofficehub was able to identify some billionaire family asset managers missing in other data sets. In this way, we help you to generate leads in a sustainable way and enable you, to expand your own database.

Wealthy families from Switzerland, EU countries, the Arab world and the whole world

Switzerland is home to numerous wealthy families and HNWIs with assets in the billions. It is therefore only logical that there are so many MFOs in the country, as in hardly any other country in the world. But Swiss Multi Family Offices do not only support local clients in asset structuring and investment. The companies in our list of the largest Multi Family Offices in Switzerland, for example, also serve clients from other European countries such as Germany, France and the UK. In addition, many wealthy families from the United Arab Emirates and Qatar rely on the expertise of Swiss asset managers and private banks. Our database of the largest Swiss MFOs provides an overview of the entire range of asset managers and advisors. From locally operating, smaller boutiques to companies that manage and grow the billions in assets of foreign partners.

Picture source: Matt Foster

Picture source (2): Nadine Marfurt

Reto (verified owner) –

Almost every important Swiss multi family office is covered. Great customer service. The list was exactly what we needed to grow our sales pipeline in the wealth management sector.