Description

List of 3 important Single Family Offices from Switzerland

Our database of the largest Single Family Offices in Switzerland is a great tool for co-investors, brokers and consultants alike in order to gain entry into this discreet world. Below, we are highlighting three major Swiss family offices so that you can get an impression of the investment groups in our dataset.

1. ARMADA Investment AG (Aegerter family office, Zurich)

Daniel Aegerter sold his B2B software firm Tradex Technologies in 2000 for $5.6BN to Ariba. Since then, he manages his investment through the ARMADA Investment AG single family office. The family office invests in different asset classes, amongst others venture capital and real estate. Current portfolio companies include Carvolution, CarbonCapture, Armored Things and Vivino. Successful exists include Oanda and Nutmeg. Real estate investments are mainly pursued through Lakeward Management AG, which focues on German properties.

2. COFRA Holding AG (Brenninkmeijer family office, Zug)

The Brenninkmeijer fortune goes back to the textile retailer C&A. Today, the family bundles its investment activities under the umbrella of COFRA Holding. Anthos Fund & Asset Management is responsible for the professional asset management. Bregal Investments is a leading private equity investor. Redevco acts as a real estate investment manager. And Sunrock implements projects in the field of renewable energies. In addition, COFRA Holding also engages in philanthropic activities and makes impact investments.

Update 2022: In October 2022, Bregal Investments announced a majority investment in PUR Projet. PUR is a developer for nature-based solutions that reduce carbon emissions of companies. Bregal Investments is the private equity investment platform of the COFRA family office.

Update 2023: In December 2022, the Cofra single family office announced a $127M acquisition of an agriculture facility in Kentucky from AppHarvest in a leaseback transaction.

3. Jacobs Holding AG (Klaus J. Jacobs family office, Zurich)

The eventful life of the entrepreneur Klaus J. Jacobs finds its continuation in the investment company Jacobs Holding. The family office was founded in Zurich in 1994 and bundles the family’s holdings. Today, this includes, among others, the share in Barry Callebaut as well as a relevant dental portfolio. Jacobs Holding invests in both private and listed companies and aims to establish global market leaders. In 2017 the investment company decided to build a dental portfolio which was established by investing in Colosseum Dental Group in Europe and the North American Dental Group in the US. New markets are meant to be penetrated as well.

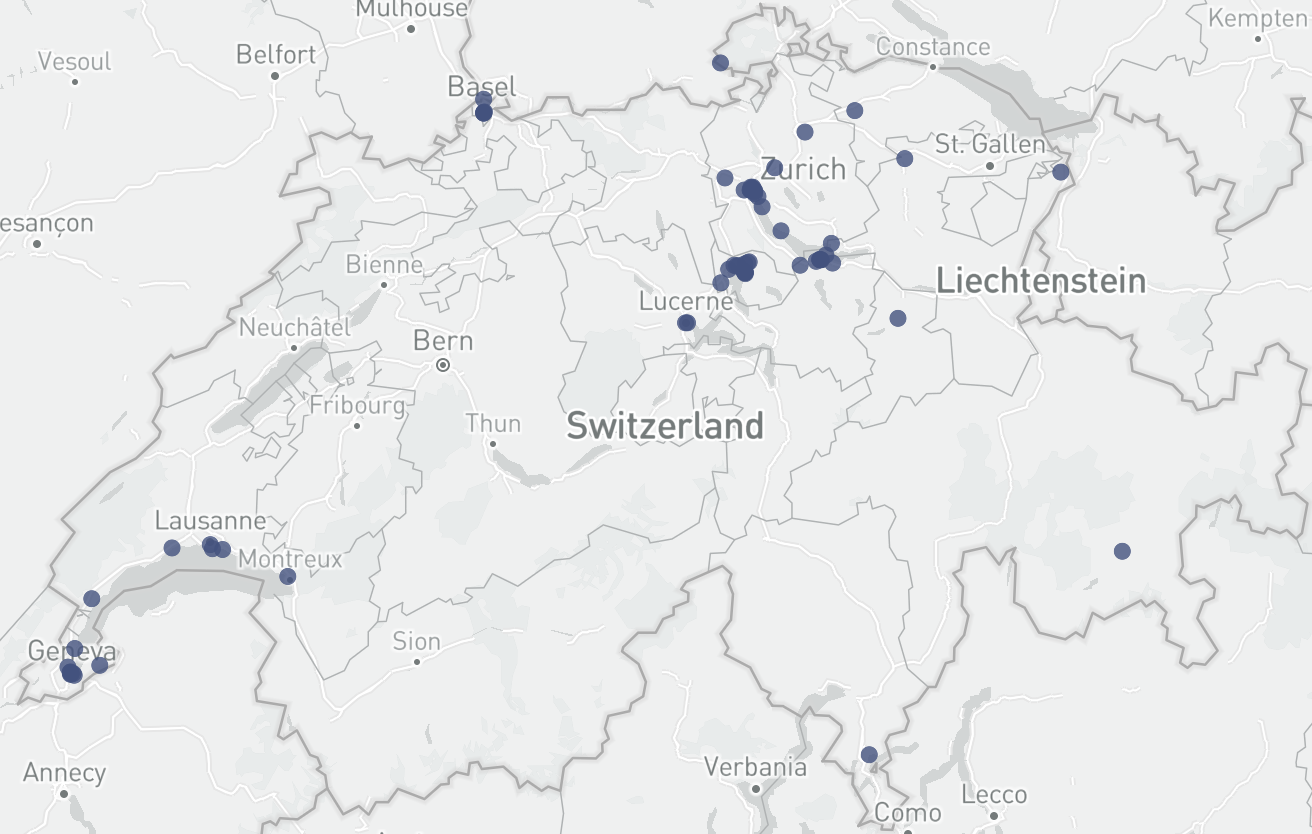

Location of Swiss investment groups

Most single family offices in Switzerland are located in the financial centers Zurich and Geneva. For a couple of reasons this makes sense: both cities offer connections to high-profile private banks and funds, are well connected and offer a high standard of living. Furthermore, many important Swiss family investment vehicles are located in Zug, Pfäffikon and Basel.

Private investment vehicles of Switzerland’s wealthy families

Switzerland is known for its wealth and often referred as tax-paradise. Unsurprisingly, there are many powerful Single Family Offices, investing in different asset classes like private equity, venture capital or real estate. Interestingly, many family offices own their own banks.

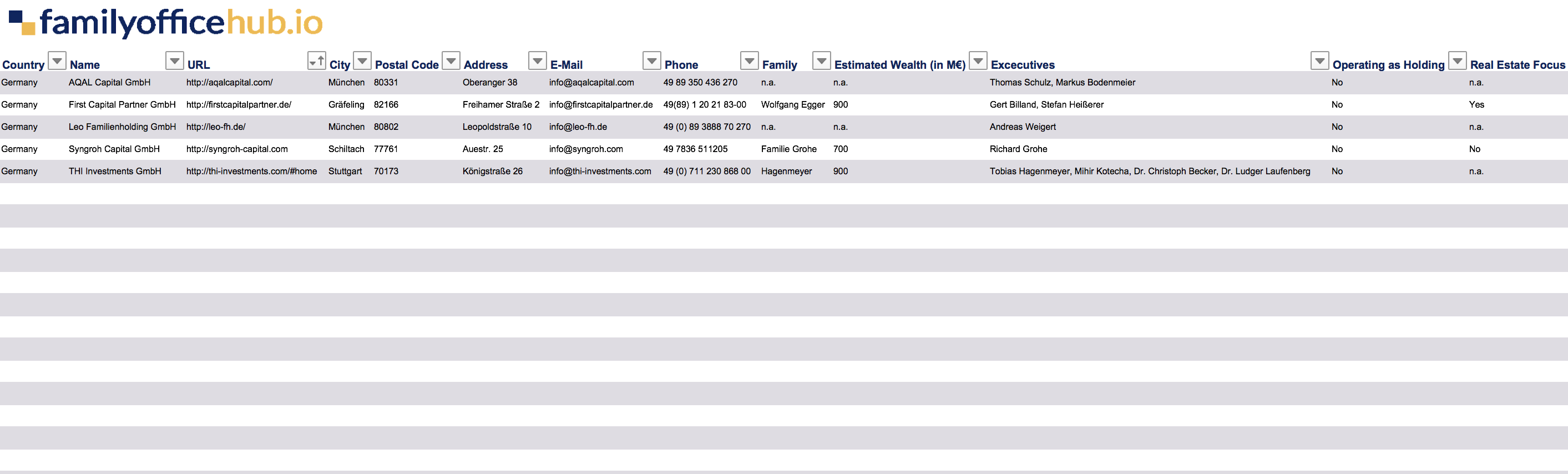

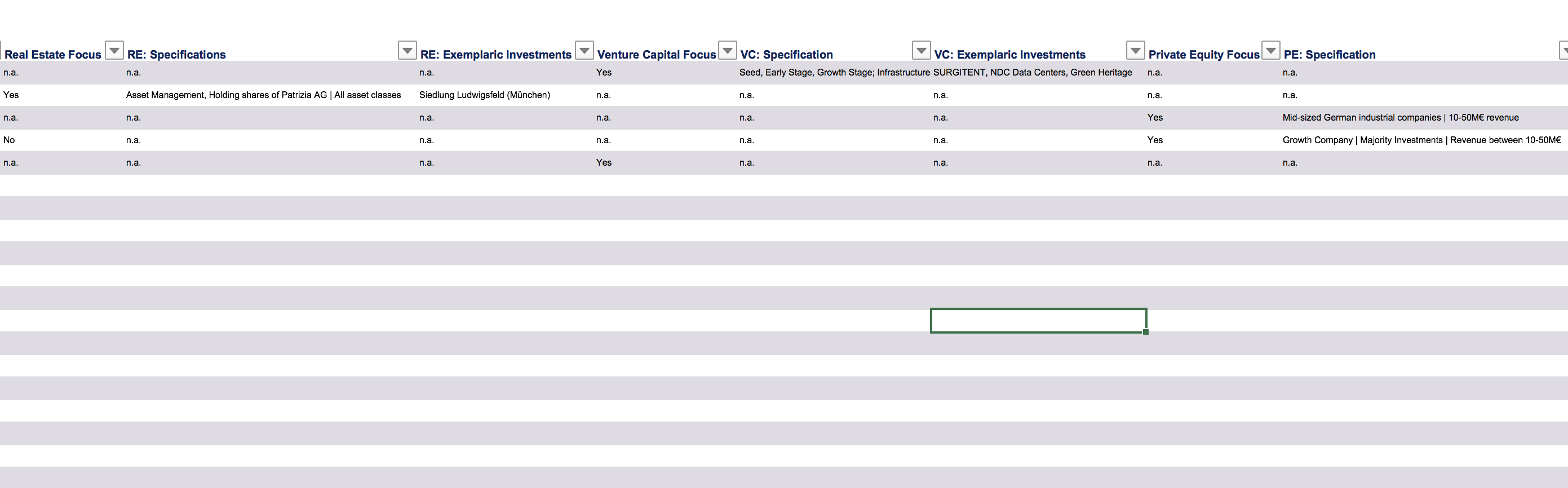

+23 columns of valuable information

We build our lists to ensure optimal usability for our clients. There are three areas included: family information, contact details and investment information. So we provide you with general e-mail addresses, phone numbers, excecutive names, exemplary investments and many more features.

Disclaimer: due to the secrecy of some family offices, we are sometimes not able to provide you with email addresses or other pieces of information. In case we don’t know the exact investment focus, the specific column is marked as n.a.

Download a preview of our database here.

We want you to know how our database is structured and what kind of single family offices we list. Therefore, we offer the possibility to download a preview file. Convince yourself how easy it is to download a family office list from familyofficehub.io.

Data points and columns in the detailed list

- Contact information (name of the family office, address, e-mail address, telephone number, URL)

- Information on the investment focus (divided by real estate, private equity, venture capital, financial market investments and others)

- Examples of completed investments in the past

- Indication of the family in the background and their estimated family assets

- Mention of the management and identification of family offices acting as holding companies

Some data points may be missing in case the data points were neither released by the respective family offices or publicly available. Furthermore, due to GDPR we are only allowed to general personal contact details.

Investment companies in Zurich: Müller-Möhl Family Office, Jacobs Holding and a dozen more

The city with the most single family offices in Switzerland is Zurich. The city is characterised by an excellent network of private banks, asset managers, investment companies and experienced advisors. Hardly any other European city has as many single family offices that invest in companies and provide growth capital. The particularly intensive focus on private equity is conspicuous. Some of Zurich’s single family offices are set up as holding companies and have played an important role in the European economy for many years. The research team of familyofficehub presents several relevant family offices in short portraits. For example, you can read more about the Müller-Möhl Family Office and Jacobs Holding in the articles we present below.

Hot spot Zug: Real Estate and Private Equity as most important asset classes for investment companies

Thanks to a very low tax rate, Zug is regarded as Switzerland’s tax haven. For this reason, a particularly large number of holding companies are based in this small town. This also applies to some of the most relevant Swiss single family offices, as can be seen from our comprehensive database. A particularly important family office based in Zug, for example, is Cofra Holding, which is backed by the Brenninkmeijer family. We present short portraits of some of the most interesting companies (see below) and report regularly on the activities of the family offices. It is therefore worth visiting regularly to be kept up to date.

Luc Heller –

The “Top 50 Single Family Offices Schweiz”-list provides a very clear and current overview and saves long and time consuming researches. In addition to that I experienced a very uncomplicated and friendly service.

This is clearly the best list on Swiss Family Offices on the market. I can only recommend this product.