Description

List of 5 important Single Family Offices in Europe

In the following we are highlighting three relevant Single Family Offices from Europe. The selected family offices have a very different investment focus and represent a good sample of our list. If you are looking for partners from the single family office world, our database is ideal for approaching valuable contacts.

1. Reuben Brothers (David & Simon Reuben family office, UK)

Born in India, the Reuben Brothers are now among the richest people in the UK. They became known to a wider public at the latest when the Reuben Brothers acquired shares in the British soccer club Newcastle United in 2021. Through their family office, the brothers hold numerous assets. These include retail properties, hotels, data centers, renewable energy projects, private equity investments and more. In addition, The Reuben Foundation was established in 2002 with an initial endowment of $100 million. The foundation supports charitable causes in the United Kingdom and beyond.

Update 2022: In June 2022, the Reuben Brothers family offie announced the acquisition of the delayed Admirality Arch hotel development. The building, originally constructed by King Edward, will be operated under the Waldorf Astoria brand.

Update 2024: In December 2023, the family office sent the luxury Manhattan hotel “The Chatwal” in default, after initiating a foreclosure proceeding after the hotel defaulted on a loan provided by the family office. The UK-based single family office is now first in line to take over the hotel.

2. Wirtgen Invest (Stefan & Jürgen Wirtgen family office, Germany)

After Stefan and Jürgen Wirtgen sold the machine manufacturer of the same name to John Deere in 2017, they increasingly made a name for themselves as investors. Wirtgen Invest is one of the most active family offices in Germany and can score points with a broad diversification of the portfolio. The company develops and invests in high-class real estate, invests globally in renewable energies, acts as a private equity player and is active on the capital markets.

Update 2023: On December 21, 2022, ABO Wind announced that it will build a 50MW solar park in Greece for Wirtgen Invest. The park will be connected to the grid in the summer of 2023. Thereby, the Wirtgen single family office shows once again its major role as major renewable energy single family office.

3. Canica (Stein Erik Hagen family office, Norway)

As Chairman of the Board and major shareholder of the Orkla conglomerate, Stein Erik Hagen is one of the richest Norwegians. His wealth is estimated at over $3 billion. Through his family office Canica, Hagen makes investments in industrial investments, financial investments and real estate. The regional focus of Canica’s investments is Northern Europe and the family office has offices in Oslo and Pfäffikon, Switzerland. Among the largest industrial investments (besides the shares in Orkla) are Komplett, Anora and Jernia. Apart from that, real estate assets alone have a value of about $1 billion.

4. Baltisse (Balcaen family office, Belgium)

Filip Balcaen has built up the Belgian flooring company Balta Group until its sale to a British private equity fund. Since then, the Balcaen single family office Baltisse belongs to the most important family office investors in Belgium and Europe. Baltisse is, amongst others, investing in private equity, real estate and capital markets. PE investments include Polflam (glass manufacturer from Poland), Recticel (thermal insulations firm fro Belgium) or Visio Healthcare (D2C healthcare firm).

5. Julen Group (Julen family office, Switzerland)

The Swiss Julen Group, which is the single family office of Mario Julen and his family. The family office owns and operates several high-class Swiss hotels, restaurants and nightlife locations, especially in the Zermatt region. Amongst them are the Hotel Zermama, the Mamacita Club or the currently developed Ritz Carlton Zermatt.

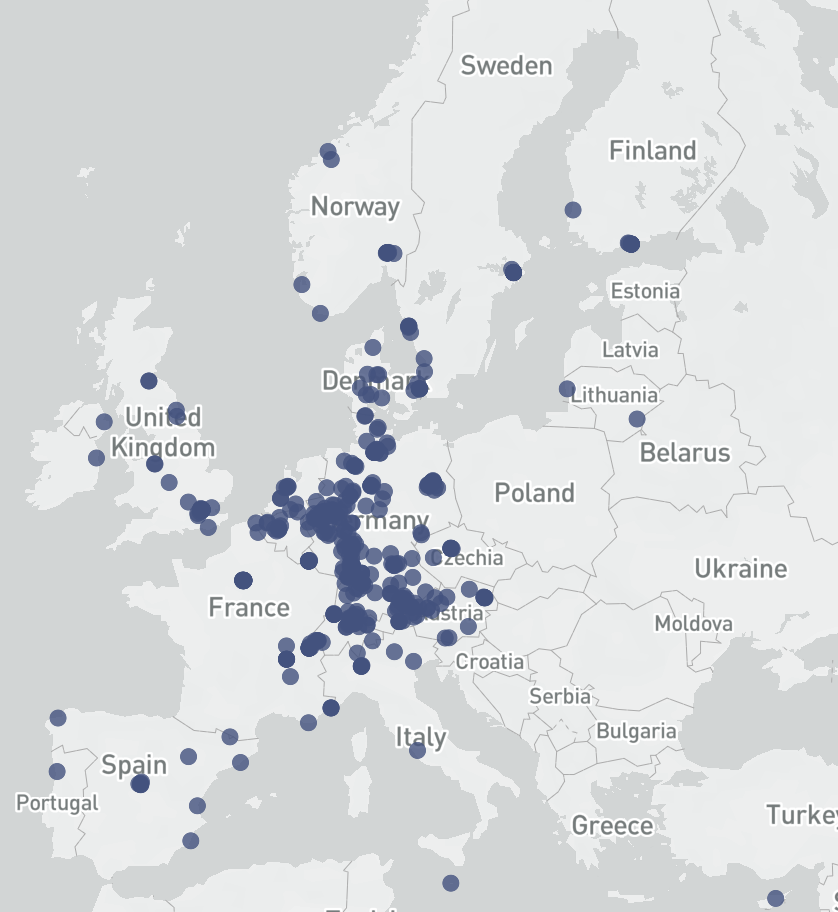

Location of Europe’s Single Family Offices

The private investment vehicles of Europe’s wealthiest families are spread throughout the continent. Some countries have a high concentration of HNWI-investors. For example, there is a high concentration of single family offices in Switzerland. In absolute values, most single family offices from our database are located in Germany: more than 300 SFOs are based in the “Bundesrepublik”. Furthermore, there are also many UK single family offices, French single family offices, Scandinavian (Sweden, Denmark, Norway, Finland) single family offices and Benelux (Netherlands, Belgium, Luxembourg) SFOs.

European Family Investment Groups

In Europe there are hundreds of wealthy families that establish a Single Family Office in order to manage their assets. We have built a huge database that includes SFOs from many European countries such as Germany, UK, Switzerland, Luxembourg, Sweden etc. This list is a true treasure for every investment and asset manager around the world. Read why we are offering Europe’s best single family office lists here.

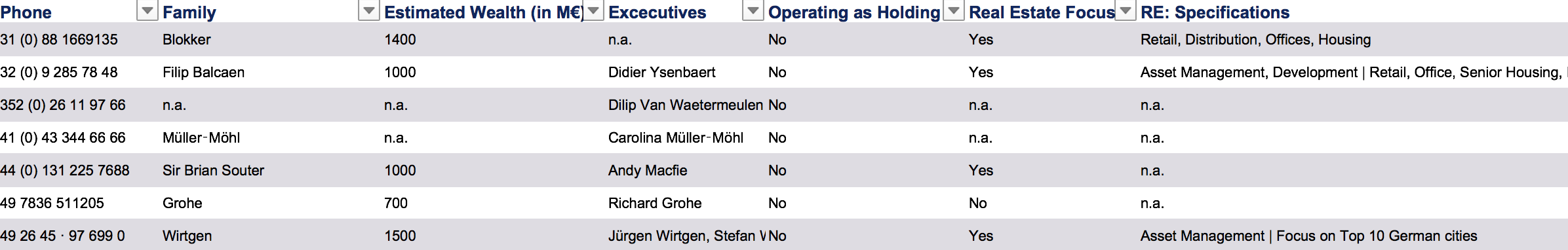

+23 columns of valuable information

We build our lists to ensure optimal usability for our clients. There are three areas included: family information, contact details and investment information. So we provide you with general e-mail addresses, phone numbers, excecutive names, exemplary investments and many more features.

Disclaimer: due to the secrecy of some family offices, we are sometimes not able to provide you with email addresses or other pieces of information. In case we don’t know the exact investment focus, the specific column is marked as n.a.

Download a preview of our database here.

We want you to know how our database is structured and what kind of single family offices we list. Therefore, we offer the possibility to download a preview file. Convince yourself how easy it is to download a family office list from familyofficehub.io.

Database of Europe’s Largest Single Family Offices

Our team analyzed the European single family office market for years to collect more than 500 single family offices in a unique database. The database can be downloaded as an easy to use excel file. A vast amount of data points is included in the list, from details about the family offices, to investment and contact details. Customers use our list for various purposes: analyzing the European family office market, finding relevant investors or identifying suitable customers. The list offers an overview of the investment firms of Europe’s wealthiest families.

Detailed Information about Investment Focus, Wealth and Executives

The list of the most important European single family offices offers detailed information about the included entries. Contact details like phone number, email address, postal address and website are in many cases included. Furthermore, we list the names of the responsible executives and the family behind the family office (if possible). When it comes to the investment focus, we collect a wide range of data points. First of all, we state if the single family offices are investing in real estate, venture capital, private equity, financial markets or renewables. We also have a free text column where we state if the SFOs are investing in other asset classes like art or agriculture. The answers range from: yes to no or “not available”. That helps our customers to identify suitable SFOs in a second. In addition, we offer detailed information about the investment focus, e.g. in which asset classes real estate focused SFOs are investing.

European investment groups invest in various asset classes

Single family offices from Europe are active in a wide range of possible asset classes. That makes sense, since through an increased degree of diversification the portfolio risk can be reduced. Furthermore, the background of the single family offices from our database differs. Some families made their fortune in real estate business, while others through the sale of a family company. Accordingly, a real estate rooted family often also invests in real estate, while entrepreneurial families might want to support new businesses through venture capital or invest in existing, mid-sized companies through private equity. Pretty common in every single family office portfolio are financial investments like stock, bonds or financial products.

Different types of investors within our list

Europe’s single family offices appear in different types. Most people understand a SFO as an specialized investment firm for a certain family. The investment professionals are carefully evaluating investment opportunities, taking care of the risk management and ensure long-term growth of the fortune, without forgetting to ensure recurring payouts. That’s the case for most family offices, but there are also other types. Some SFOs develop out of an existing family business which starts to invest in business-field related ventures and opportunities. Others are building their family offices – for example – around their real estate business. While some single family offices are held as stock-noted family holdings. Rather new is that some single family offices are also offering their services for external clients (to split the fixed costs of running an investment firm and to enlarge the assets under management). The type of the single family office mainly determines the investment approach and focus.

Case Studies: The use cases of our dataset

Our clients use our single family office Europe list for different purposes. The basic use case is identifying possible investors for properties, venture capital and private equity funds, financial products, renewables, art, agriculture or other assets. The many different columns help our customers to narrow the list down to relevant single family offices for their use cases within seconds. Furthermore, our lists helps many firms to find suitable clients. The listed single family offices are holding directly or indirectly Europe’s most important companies and are thereby important possible customers.

Our service: free preview list, free updates and top-notch customer support

We care about our customers and offer many features around our lists. Our top-notch customer support is always there for you and can be reached via phone, live chat or email. Interested customers can receive a free preview file, either via our support or through the feature on this page (see above). Within one year after the purchase of the list our customers will receive free updates and extensions as additional service.

Portraits of relevant investment groups: Proventus (Sweden), Baltisse NV (Belgium), Souter Investment (UK) and more

Are you looking for insights from the family office industry? Then you have come to the right place. Because we not only develop our database of the most important single family offices in Europe, but also provide you with valuable information from the scene. We do this on the one hand through our newsletter and articles on our website. On the other hand, we present portraits of relevant investment companies on a regular basis. This gives you a better understanding of the connections and functioning of the investment companies of wealthy families. The portraits can be found under the respective Family Office lists. If you have any questions about our contributions or know of other family offices that we should definitely present, we would be pleased to hear from you.

Coverage of all relevant countries in Europe: from Germany and Switzerland to France, the Nordics, Benelux and beyond

Our aim is to be the leading research platform for and about family offices throughout Europe. For this reason, we cover the entire European market with all its financial centres. However, our focus is not only on London, Luxembourg, Zurich, Frankfurt and Co. but also on rural areas. This enables us to identify the investment companies of wealthy families who have been managing large family assets for decades. Other research providers often overlook these family offices because they do not sufficiently enter the economic structure of a country. If you are looking for single family offices for certain countries in Europe, we would be pleased to recommend our country overviews. Particularly popular with our clients are the lists of the largest single family offices in the UK, Germany, Switzerland and the Benelux region. But you will also find other overviews in our online shop or might be interested in individual research tasks, which we are glad to work on.

Picture source: Jan-Philipp Thiele

Investments of Single Family Offices in Europe

In our unique family office blog, we regularly present relevant family office deals to our readers. In the following, we introduce you to relevant deals of European family offices that are also covered in our database.

Fegel single family office acquires motorsport media network (2023)

In June 2023, the single family office of Gary Fegel, GMF Capital, acquired a controlling stake of Motorsport Network Media. The firm operates different racing outlets, like motor1.com or motorsport.com. The acquisition was pursued through GMF Media, an affiliate of the Fegel single family office.

Dutch Pon family launchs family office (2022)

The Dutch retail family Pon launched its family office Knop Investments in 2021. Now, the family office is growing through key hires. The investment strategy will probably be inspired by former investments of Ponooc, the venture capital arm of the family company Pon Holdings B.V.

Grohe single family office invests in medical technology company Zircon Medical (2021)

The German single family office of the Grohe family, based on the Billion-dollar family company for sanitary equipment, was just created a few years ago. Now, in February 2021 the investment firm conducted one of its first venture capital investments by participating in Zircon Medicals funding round. Zircon is working on innovative dental implants.

Arnault single family office invests in private equity deal and gets minority investor in Birkenstock (2021)

One of the most influential and active family offices when it comes to large scale investments in the consumer and luxury industry is definitively the one of the Arnault family. Bernard Arnault is a French businessman who owns large parts of luxury conglomerate LVMH. He is one of the wealthiest Europeans with an estimated net worth well above €100Bn. In February 2021, a private equity firm related to him (L Catterton) bought a majority stake of German shoe producer Birkenstock. His family office also acquired directly a minority share.

Single Family Office near Munich acquired mixed-use building (2021)

Many single-family offices from our list are also active real estate investors. A good example of this is the Hartinger family office from Rosenheim, a city near Munich (Germany). The family office continuously acquires buildings in the region. In a transaction in January 2021, the Hartinger family invested in a mixed-use building in Rosenheim that includes rental as well as commercial unit. The building was created in 1900 and has an estimated rental income of €0.5M per year.

French single family office invests in Quantom Genomics (2020)

Pierre-Edouard Stérin’s single family office invested in Quantum Genomic’s €20M funding round. Thereby, Quantum Genomics can focus on its clinical trials and boost its industrial production. Stérin ist the founder of the SmartBox Group and an active investor in venture capital. Quantum Genomics is also listed on the Euronext stock exchange.

German single family office invests in new venture capital fund for bioeconomy (2020)

The German single family office of the Hettich family invested in ECBF Management’s most recent “European Circular Bioeconomy Fund”. The German single family office participated in the first €82M close of the fund. The Hettich’s family company (the Hettich Group) is a global leader in furniture fittings. The investment shows that many family offices invest in venture capital funds, thereby diversifying portfolios and securing shares of promising startups.

Picture Source: Aron von de Pol

Aron –

Bought this list to find investors for our client, a mid-sized industrial company. The list of familyofficehub helped us to find dozens of suitable family investors within minutes. We sorted the list by private equity investment (yes/no). Results were either PE focused family offices or family holdings which build up their portfolio.

Two things could be improved:

– could be more sfos from Nordics, spain – also a middle east list would be nice

– there are really lots of information, which is not bad, but there could be also are more condensed version. we appreciated the depth, but it took us some minutes to understand all the columns

An –

Great list with extraordinary data quality, many of the major sfos are listed (I can say that with confidence as an industry insider).Nevertheless I’ll only give four stars since a few SFOs are missing.

FORGET –

Very useful database in a segment which lacks transparency.

Good to have an estimate of the size of the FOs.

Our local salespeople were very happy to find names they didn’t know.

Commitment to enlarge the list.

Caroline (verified owner) –

After using familyofficehub’s European database for a few months now, I can say with confidence that it is of strong quality (especially compared to competing US products) and that the team is constantly trying to expand it with relevant additional investors. I believe this is probably the best source of European family office data on the market today, which is a real achievement considering familyofficehub only launched at the beginning of the year. Do keep it up!

Benjamin E Catling (verified owner) –

Decent information on family offices is incredibly hard to find and this is the best source I’ve come across. just having the list is useful but the detailed information on VC investements was a great help to me looking for investors four a startup I’m working with. The information is not all there as would be expected for such a conciously secretive world but as I understand it they are constantly updating the database.

Jan was extremely helpfull with my questions before buying and when I made some mistakes ordering the wrong items Jan helped me sort things out in a flash. Super impressed with the customer service. Very refreshing!

Max F. (verified owner) –

Very good database. 4* because a few e-mails are missing and some e-mails are “info@” and not specific contacts but these instances are quite marginal.

Haven’t found any other such database elsewhere.

+ The team (founders) is very responsive and helpful.

Keep it up

Matteo Marzagalli (verified owner) –

I bought the list and I immediately found it very useful: easy to analyse and fast to check every record.

After two weeks of my purchase, I automatically received the updated version, that it is absolutely a must in this kind of service. I would definitely recommend it!

Constantin Pellissier (verified owner) –

As a French-Belgian M&A adviser, this list has been super useful for a significant fundraising which I needed to launch on a European scale and not strictly on my home base. In short, super valuable data and also great update service! Thank you FamilyOfficeHub!