Description

List of 3 European real estate single family offices

A core asset class of many single family offices is real estate. Through the relative stability of the asset class, many family investment vehicle are actively investing in properties and property developments. In the following, we are introducing three interesting real estate family offices from our list.

1. Wirtgen Invest (Neustadt, Germany)

The German Wirtgen brothers sold their family company for building machinery to John Deere. From the billions of the proceeds of the transaction, the Wirtgen Invest family was launched. A major investment focus of the family office is real estate. One exemplary portfolio object is Taunusgasse 8 in Frankfurt. The 20 storey skyscraper T8 offers more than 30,000 sqm space. The family office also invests in residential real estate developments, like in Stuttgart’s Stafflenbergstraße.

Update 2024: Also in the past year, Wirtgen Invest was one of the most active family office investors in the property market. For example, in September 2023, the family office acquired the newly developed Motel One in Munich, Germany.

2. Baltisse (Gent, Belgium)

Baltisse is the Belgian single family office of the Balcaen family. Besides capital markets and private equity, the family investment firm actively invests in real estate. Featured investments include the redevelopment of the former IBM tower in Brussels or the AXS Namur redevelopment project. Geographically, Baltisse is active in Belgium, Luxembourg, Germany, Romania and the United States. The portfolio comprises a combined space of 300,000 sqm.

3. Cofra Holding (Zug, Switzerland)

The Cofra Holding is the family holding of the billionaire C&A owner family Brenninkmeijer. Redevco is the real estate arm of the family investment group. Through Redevco, Cofra is managing 306 assets with a combined value of €7.5B. So far, the focus was on high street properties and retail parks in European countries like Germany, the Netherlands, France, Spain or UK. All to-be-acquired objects should have an investment volume of at least €10-20M. Exemplary objects in the portfolio are the Princes Square in Glasgow, a object in the Tauentzienstrasse in Berlin or the Galleria Inno. Since 2018, Redevco is also investing in residential real estate through a €500M vehicle. A first project was realized together with AM Real Estate Development in Amsterdam.

European Real Estate Family Investment Groups

Many of the largest European Single Family Offices are investing in real estate opportunities. Either through own developments, funds or associated real estate investment firms. Many of the most prestigious buildings in major European cities like Barcelona, Munich or Paris are owned by HNWIs and their family offices.

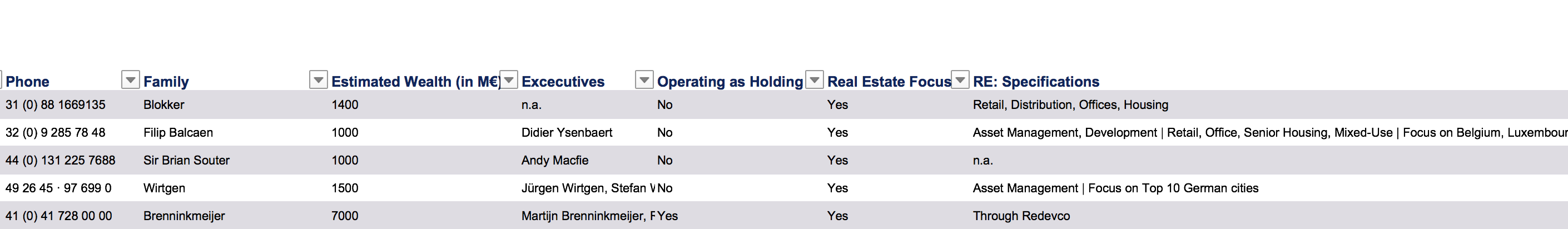

+23 columns of valuable information

We build our lists to ensure optimal usability for our clients. There are three areas included: family information, contact details and investment information. So we provide you with general e-mail addresses, phone numbers, excecutive names, exemplary investments and many more features.

Disclaimer: due to the secrecy of some family offices, we are sometimes not able to provide you with email addresses or other pieces of information. In case we don’t know the exact investment focus, the specific column is marked as n.a.

Database of European real estate family investment vehicles

Throughout the last years our team has built the most extensive database of European single family offices, available as an easy to use excel file. The listed single family offices are investing in various asset classes. Real estate is one of the most popular of them. This product is a database of all the family investment groups active in real estate investment or asset management. The list helps you to identify relevant real estate buyers or customers for your business in whole Europe. The list includes single family offices from Germany, UK, France, Benelux, the Nordics and many other countries.

Detailed information about investment focus, contact details, family wealth and executives

Our real estate single family office list offers a wide range of information about Europe’s most important family investment groups. Basis information about every single family office is – if available – the name of the family behind the family office as well as the family wealth. Besides that, every possible contact detail is included: URL, phone, address, email. Also the names of the executives is included. We can offer a very granular overview of the family office’s investment focus. Possible asset classes range from real estate to financial products. Within the real estate focus we give a description of the detailed focus (asset management, development, etc.) and exemplary projects and investments.

Different types of real estate investment: core objects, value add, project development

European single family offices are investing in various types of real estate. Some of them are focusing on existing core objects in large cities like Berlin, Paris, London or Madrid. For example, the Swiss real estate firm Reba has a mandate to acquire residential real estate in Berlin for approximately €100M. Other family offices are especially seeking value add objects to increase their return. Some single family offices also have extensive in-house experience and develop own real estate projects. We will introduce you to some exemplary single family office from the list.

Picture source: Jörg Angeli

Confidential (verified owner) –

Hundreds of single family offices in real estate in Europe, nice