Description

List of 3 large startup investor single family offices

Investing in startups got increasingly important for global single family offices throughout recent years, especially fueled through the low-interest rate environment. We are highlighting three exciting single family offices from our keyword-crawler based list.

1. Pritzker Group (United States)

The Pritzker Group is an US single family office launcehd by Tony and J.B. Pritzker. The family office has three major investment verticals: private capital, venture capital and asset management. In their venture capital vertical the startup investor family office invests from $0.5-5M in initial rounds, with the option to also participate in following rounds. Investments include Fleetmatics, LeftHand Networks, coinbase or Dollar Shave Club.

Update 2023: Portfolio company VTS recently announced the $100M acquisition of competitor Rise Buildings.

2. Ambient Sound Investments (Estonia)

Ambient Sound Investments is the single family office of four early employees of Skype, established to hold their minority stake in the video call company. The family office invests in Europe, the United States and Asia. The family office is an active venture capital investor, investing in funds as well as direct investments. Portfolio funds are Karma Ventures, Plural Platform or Golden Gate Ventures. Direct investments were, so far, Nanotronics, Pomelo or Starship Technologies.

3. Financière Saint James (France)

Financiere Saint James is the French single family office of vente-privée.com co-founder Michaël Benabou. The family office is an active venture capital and startup investors. The family office acts as early-stage investor with initial checks starting from €200K, able to invest in follow-on rounds up to €5M. Current portfolio companies include Lydia, colonie, or Seyna. The family office also invests in venture capital funds, such as andreessen horowitz or atomico.

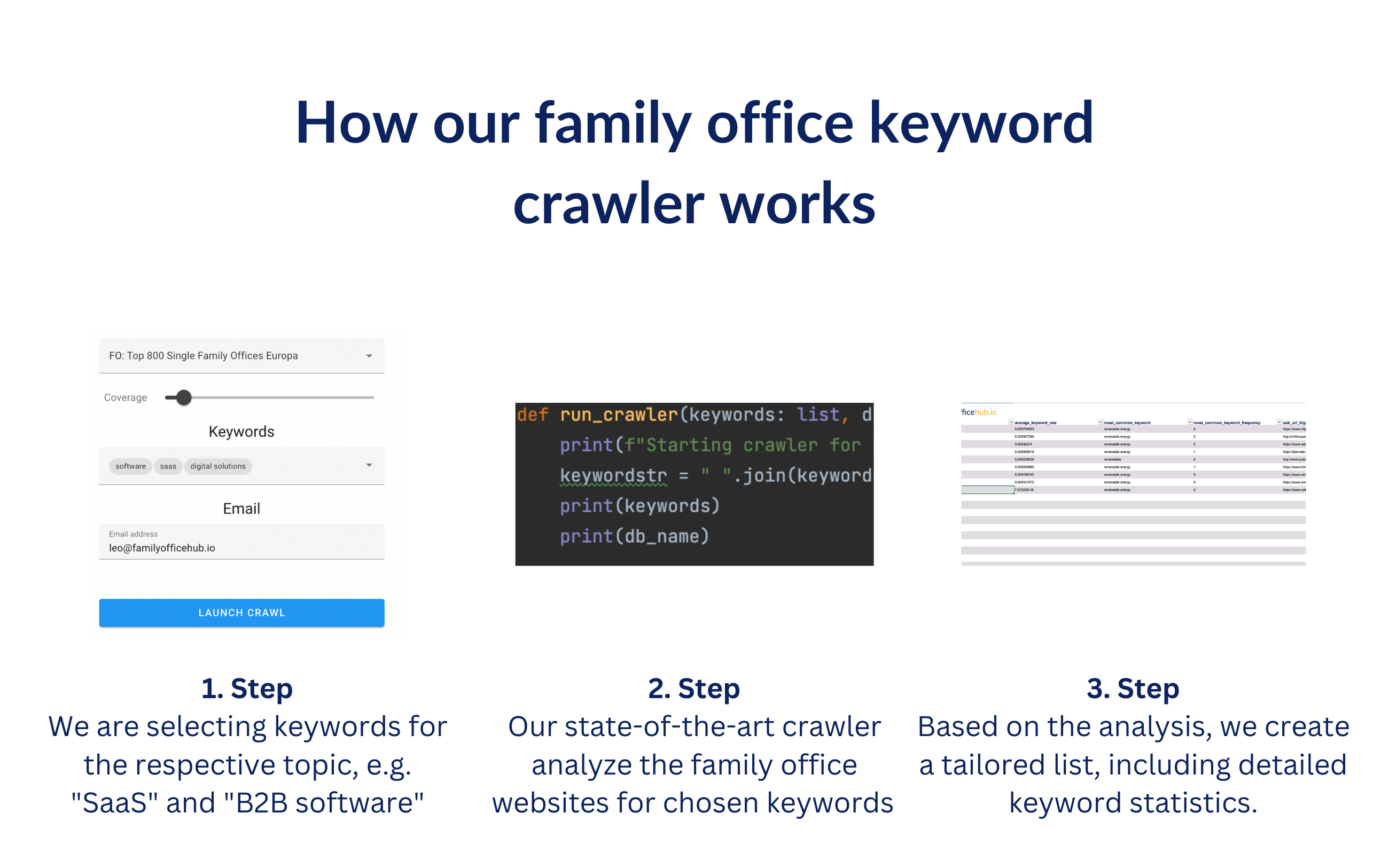

Based on our keyword crawler

We have built the list with the help of our keyword crawler tool that screens the website of the family offices for target keywords. In the following, we show a general overview of our crawling process, as well as statistics about the respective keywords. We have crawler the family office websites for the keywords:

- venture capital

- seed investment

- startup investment

- venture investment

- seed funding

The most often found keyword was “venture capital” with over 12,000 occurrences, followed by “seed funding”.

Reviews

There are no reviews yet.