Description

List of 3 important Single Family Offices from the UK

We present three particularly relevant single family offices from the United Kingdom. This will give you an idea of the companies you will find in our list. With our database we support successful co-investors and advisors in attracting new partners.

1. Reuben Brothers (David and Simon Reuben, London)

According to the latest Sunday Times Rich list, David and Simon Reuben form the second richest family in the UK. Their single family office, Reuben Brothers, is one of the most active investment groups in the United Kingdom. Reuben Brothers’ investment profile is extremely diverse, spanning both private equity and real estate investments. In the recent past, the Reuben brothers have attracted attention for their share acquisition in the Newcastle United soccer club. However, they are also very active real estate entrepreneurs, developing their own properties and acquiring properties mainly in Europe and the USA.

Update 2024: In the end of the last year, The Reuben Brothers filed a foreclosure procedure for The Chatwal hotel in Manhattan, New York, since it defaulted on its mezzanine debt, which was provided by the family office. Consequently, The Reuben Brothers are first in line to take over the hotel soon.

2. Grosvenor (Duke of Westminster, Chester)

Headed by the Duke of Westminster, the Grosvenor family concentrates its investment activities through an internationally present family office. Divided into three segments (Property, Food & AgTech and Rural Estates), Grosvenor combines private equity and real estate investments. For more than 340 years, the family mainly focuses on property investments. Grosvenor develops, manages and invests in Europe, Asia and the US. Two exemplary investments are Mayfair estate and Belgravia estate in London.

3. Souter Investments (Sir Brian Souter, Edinburgh)

Souter Investments is the family investment office of Sir Brian Souter, a Scottish businessman. While its wealth is based on entrepreneurial activities in transportation, the Single Family Offices invests in a very broad spectrum in private equity. The portfolio of Souter Investments spans more than 30 firms and since its inception in 2006, it has already invested in more than 60 companies.

Update 2023: In September 2022, Souter Investments announced that it sold Stone Technologies, an IT solutions provider, to Canadian firm Converge Technology Solutions. The UK family office invested in Stone Technologies in 2019 and acquired a majority share.

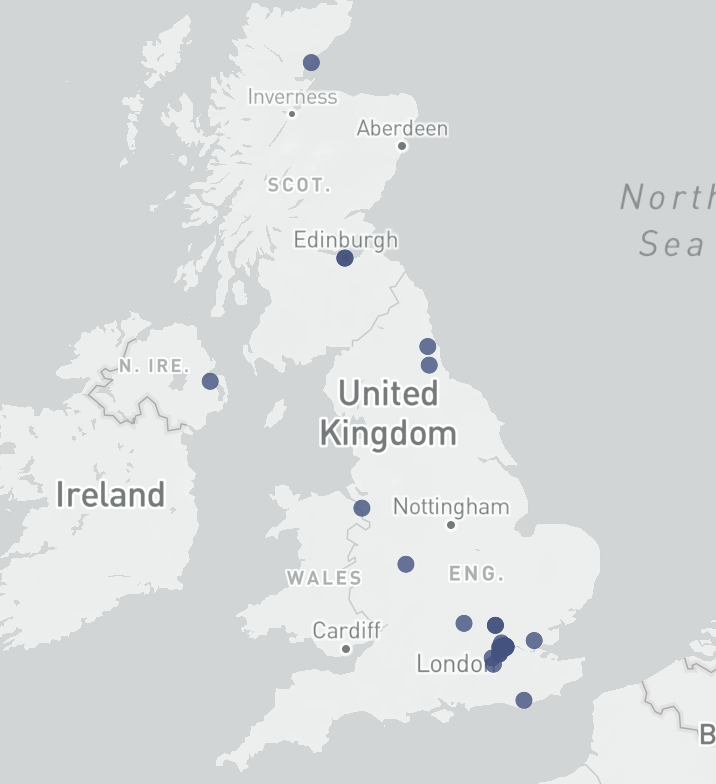

Location of investors from our list

One of Europe’s most important financial centers is London. Accordingly, by far the most UK single family offices are located in England’s capital: more than 60 single family offices have their HQ in London. Further important locations for UK single family offices are Jersey or Edinburgh.

Private investment vehicles of wealthy families from England, Scotland, Wales and Northern Ireland

Many high net worth individuals use Single Family Offices in order to manage their assets. In UK, the richest British families use SFOs to invest in real estate, private equity and other asset classes. However, also international families set up their SFO in UK (preferably London) since the United Kingdom is a popular financial hub in Europe and the world.

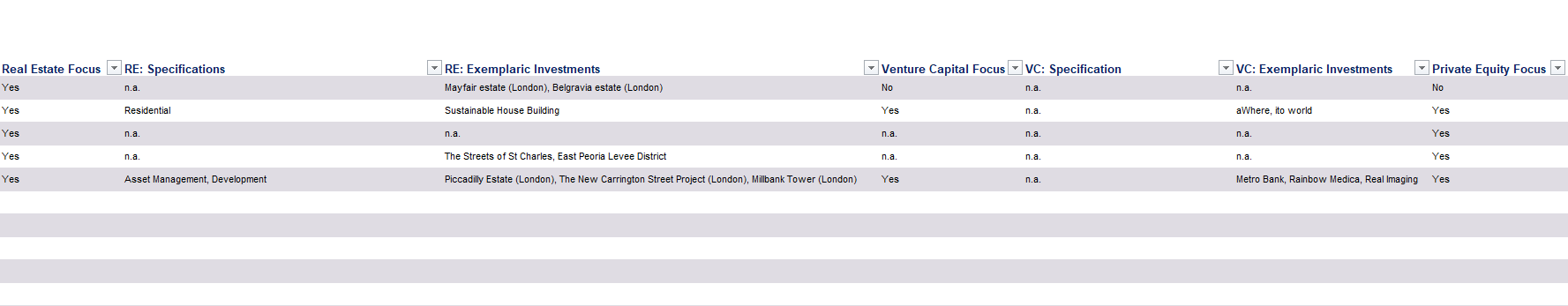

+23 columns of valuable information

We build our lists to ensure optimal usability for our clients. There are three areas included: family information, contact details and investment information. So we provide you with general e-mail addresses, phone numbers, excecutive names, exemplary investments and many more features.

Disclaimer: due to the secrecy of some family offices, we are sometimes not able to provide you with email addresses or other pieces of information. In case we don’t know the exact investment focus, the specific column is marked as n.a.

Download a preview of our database here.

We want you to know how our database is structured and what kind of single family offices we list. Therefore, we offer the possibility to download a preview file. Convince yourself how easy it is to download a family office list from familyofficehub.io.

UK Family offices: a market overview

The UK family offices belongs to the most sophisticated ones in Europe. There are many hidden family offices in the United Kingdom that are important players in European financial markets, but are nonetheless quite invisible. The types of family offices range from hedgefund-like investors to asset management companies of the British aristocracy. A huge difference in the UK is that most family offices try to hide their assets and investment focus as much as possible.

Database of family investment groups from the United Kingdom (UK)

We offer a unique database of the most important single family offices in the United Kingdom. The listed single family offices are a part of our list of Europe’s largest and most important SFOs. Single family offices are the investment firms of wealthy families. Our UK SFO database can be downloaded as an easy-to-use excel file with many features. For every single family office, we list the investment focus, contact details and information about the family.

Why the Great Britain family office market is special

The family offices in Great Britain / the United Kingdom are especially interesting. There is no other country in Europe where such a combination of old money investment firms and new, entrepreneurial family offices can be found. A huge percentage of real estate in England belongs to old, aristocratic families. As a consequence, many UK single family offices are built around the family’s real estate portfolio. Grosvenor Estate, the family office of the billionaire Duke of Westminster, is a good example for this case. On the other hand, there are also many family offices which developed from the wealth of entrepreneurial families (who, for example, sold their business and now have to manage their wealth). Great Britain is also especially interesting because it houses one of the most popular and dynamic financial centers: London. In the city with more than 10M inhabitants, there are many prestigious investment banks and investment firms. Also the wealth management sector is deeply rooted in London.

Picture source: Aron Van de Pol

richard bottger –

I have been an investment professional in the alternative asset space for 20 years with the last ten years as as a senior portfolio managers of a Global Absolute Return Fund. A great deal of time and effort is spent on uncovering discreet capital pools increasingly more often associated with family office environments where investment restrictions are minimized and where investors understand the nuances of patient capital for longer term capital appreciation. The familyofficehub.io provides a compelling product that is sufficiently detailed and accurately displayed. I will certainly do repeat business with the organization and applaud the offering.

T. Gunnarsen (verified owner) –

We bought this list in May 2022 and used it for our family office research efforts in UK. Our main family investment clients from UK were already part of the list. We also found some new leads and will get in touch with them through LinkedIn. Can recommend this list.