Description

List of 3 large biotech investor single family offices

Single family offices are getting increasingly important investors in the biotech and life sciences spaces, thereby financing breakthrough innovations in the pharmaceutical industry. For instance, the Strüngmann family office were major investors in Covid vaccine maker Biontech. In the following, we are introducing you to three single family offices that are part of our list and that mention biotech keywords on their websites.

1. Bellco Capital (United States)

In 2003, billionaires Rebecka Belldegrun and Arie Belldegrun launched Bellco Capital. Arie Belldegrun is an Israeli-American oncologist that founded Agensys in 1996 and Cougar Biotechnology in 2003. Both companies were sold for hundreds of millions of dollars. Bellco invests in life science, real estate and other sectors. The life science portfolio of the family office consists of firms like Cell Design Labs, Kite Pharma and Neogene Therapeutics. Our keyword crawler found a biotech keyword rate of 2% on the Bellco Capital website. Neogene Therapeutics is a preclinical biotechnology firm working on T cell therapies for cancers. The oncology startup was launched in September 2018 by stem cell researchers Ton Schumacher and Carsten Linnemann.

Update 2023: The US single family office also invests in the life sciences sector from an real estate perspective: together with Tishman Speyer, Bellco raised a $3bn fund for life science real estate in 2023.

2. BORN2GROW GmbH & Co. KG (Germany)

BORN2GROW GmbH & Co. is the startup investment focused single family office of German retail billionaire Dieter Schwarz. The family office invests €0.5-1M in first rounds and can offer follow-on investments to up to €5M. The family office portfolio consists of firms in the tech, life science and Industrial sector. Life science investments include Preventius, Implandata or PL BioScience that works on stem cell solutions. We found an average biotech keyword rate of 1% on the BORN2GROW website.

3. Waymade Capital (UK)

UK millionaires Vijay and Bhiku Patel manage their net worth through the family office Waymade Capital. The family investment firm is active in Pharma, Property, Private Equity and Philanthropy. Through their firm Pharmanovia, the family office acquires post-patent prescription medicines form large cap pharma firms and develops line extensions. The drug portfolio of the family office-financed pharma firm consists of products in the Cardiovascular, Endocrinology, Neurology and Oncology sector. The website of the Waymade Capital family office has a biotech keyword rate of 1.8%.

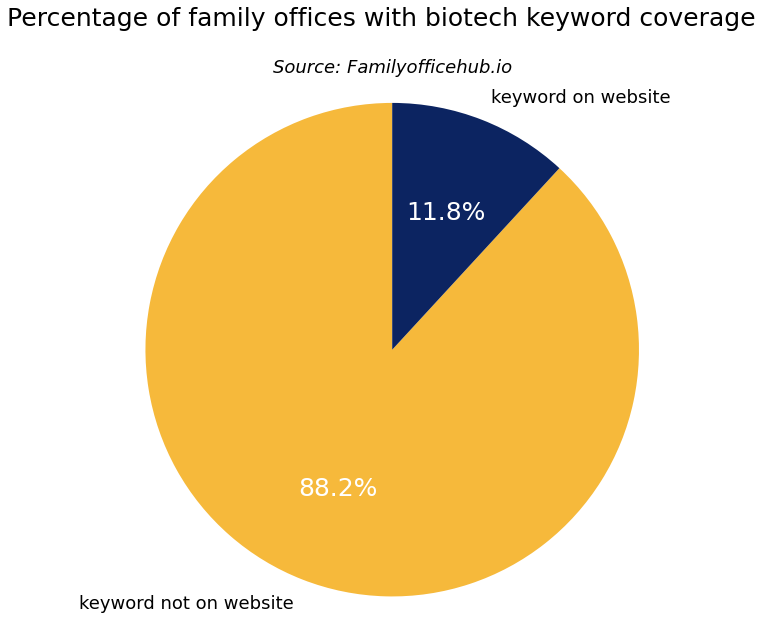

In this list we combine two unique assets: our global database with more than 1,600 global single family offices and our expertise in building web crawlers and analysis tool. For this list, we checked if the websites of the family offices from our database cover biotech-related keywords, such as „biotech“ or „life science“. This list includes all the data from our family office lists, as well as dedicated keyword analysis columns. The list include all family offices from our database that have at least 1 relevant biotech keyword occurrence.

Keyword Crawler Methodology

Our database of the largest family offices has more than 1600 entries. To search all entries manually for relevant biotech keywords would be impossible. Therefore, we have developed a Python-based web crawler that automates the work in a 3-step process:

- First we search every family office website in our database for subpages. This works like a Google, which crawls recursively through every wepage.

- We then calculate various statistics (see below) based on the identified subpages. In the keyword-analysis we count the mentioned keywords and set them in relation with the total number of words on the website. This way we can highlight the subpages that have the highest keyword occurences.

- We combine the results of our analysis with the data of our global family office database. So, you get a list with the relevant family offices in the Biotech area.

Included datapoints

First, the here offered list includes all the columns and data points of our regular family office list. The information is extended by the results of our keyword analysis. The list contains contact details, detailed investment focus information, executives and background information and specific data namely:

- total_frequency (e.g.: 16) – total counted occurrences of keywords on family office website

- average_keyword_rate (e.g. 0.1) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „biotech“) – keyword that was counted the most often on family office website

- most_common_keyword_frequency (e.g. 10) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. https://familyofficeabc.de/biotech) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.1) – highest keyword rate per subpage

- frequency_per_keyword: {‘bioscience’: 185, ‘biosciences’: 4, ‘therapeutics’: 1, ‘pharma’: 0, ‘pharmaceutical’: 0, ‘clinical development’: 0, ‘life science’: 13, ‘life sciences’: 26, ‘drug development’: 0, ‘drug discovery’: 0, ‘biotech’: 4, ‘medicamento’: 0, ‘médicament’: 0, ‘medikament’: 0, ‘arzneimittel’: 0} – dictionary of number of keyword occurrences per keyword

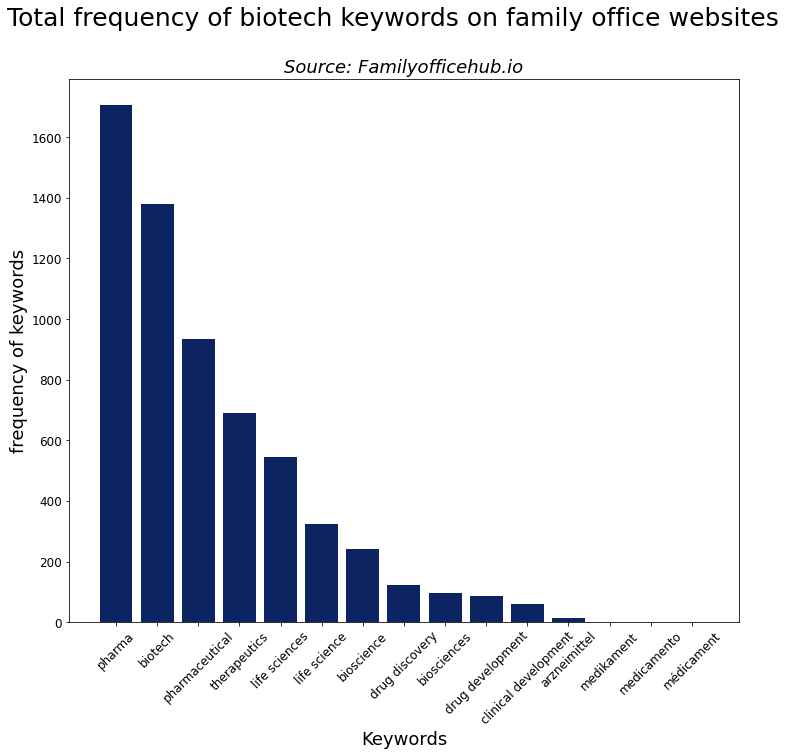

Analyzed keywords and crawler settings

Our crawler analyzed the family office websites for the following keywords: ‘bioscience’, ‘biosciences’, ‘therapeutics’, ‘pharma’, ‘pharmaceutical’, ‘clinical development’, ‘life science’, ‘life sciences’, ‘drug development’, ‘drug discovery’, ‘biotech’, ‘medicamento’, ‘médicament’, ‘medikament’, ‘arzneimittel’.

Thereby, we cover biotech-related keywords in the most important languages for the countries covered in our database. Our crawler analyzed every family office website for at least 60 seconds.

Picture source: Nik Lanus

R Lemmerer (verified owner) –

The family office information itself is decent and useful. Personal contact details would even increase my willingness to pay.

However, the keyword search based results are adding great value by showing the most fitting family offices in the investment vertical. Have never seen something like this; highly recommended.