-

Rated 5.00 out of 5€699,99 including VAT

-

Rated 5.00 out of 5€599,99 including VAT

This article directly stems from the research process for our US single family office database. Our list of US single-family offices includes the most important US family investment vehicles that invest in promising startups, emerging markets, real estate, and fixed-income ventures.

This article includes three single-family offices based in the US that have a keen interest in emerging markets. Emerging markets can provide an opportunity for single family-offices to diversify their portfolio and enjoy an economic growth premium over more developed countries. All of the family offices included in this article can be found on our list of the largest US single family-offices.

1) Berggruen Holdings (Los Angeles, California)

Berggruen Holdings is an investment management firm that is active in a wide range of financial sectors including real estate, alternative energy, industry start-ups, and direct private equity investments. The group acts as an investment vehicle of the Nicolas Berggruen Charitable Trust which has completed over 100 investments over the last 20 years. The California-based firm acts alongside its management teams, developers, and assets managers to seek suitable investment opportunities provided they can offer positive cash flow. Berrgrruen has also been actively seeking investments in emerging markets and has identified opportunities in Turkish and Indian markets. In Turkey, the group has invested in the metal mining industry whereas in India the group has acquired an interest in car rental and industrial equipment rental services.

2) Omidyar Network (Redwood City, California)

Omidyar Network has adopted a hybrid approach that combines the activities of a limited liability company with a private philanthropic foundation. This approach allows the family office to support innovative start-ups that tackle social challenges and also provides an opportunity for the group to offer grants, fund research, and not-for-profit ventures. Omidyar has targeted responsible technology investments to produce a positive impact on society as well as promoting diverse societies through its ventures.

3) The Sobrato Organization (Mountain View, California)

The California-based firm was established in 1979 by John Sobrato and is now led by Matthew Sonsini and Rob Hollister, still maintained as a family-owned firm independent of investors or joint venture partners. The firm has become a specialist in real estate development particularly in Silicon Valley and philanthropic pursuits, having donated over $379m in cash and real estate to the Silicon Valley community. The firm consists of three investment pools including family holdings, development companies, and family foundations. The family holdings sector targets public and private equity investments including direct, co-investments, and first-time funds in collaboration with others to construct innovative fund structures.

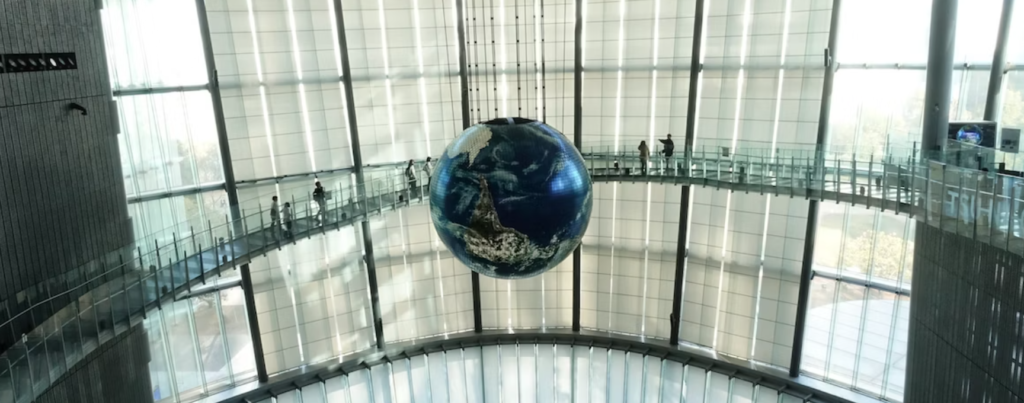

Picture source: LYCS Architecture