This article belongs to our exclusive single-family office guidebook, where we give guidance on the most relevant topics for newly established and already existing family investment vehicles. It was contributed by Danai Musandu.

Perspective | Introduction

Changing your perspective can change your experiences and open opportunities in nascent markets. Any discussion on impact investing in Africa must begin with an honest reflection of the context and the hyperbolic nature of risk perception that accompanies it. Firstly we must consider that investing in Africa typically comes with an exaggerated risk perception based on fear of the unknown rather than decision-making driven by managing the unknown. Secondly is to take into account that impact investing in Africa without good and well thought-out measures can easily become philanthropic poverty porn without fully appreciating the raw market opportunity and ability to make meaningful dual returns. Lastly, is to caution from falling into the inherent trap of assuming that one size fits all in a continent with 54 nations states, over 3000 ethnicities speaking more than 2100 languages.

In this article we shall explore the current opportunity in impact investing in Africa for family offices while discussing what this opportunity will require from LPs in order to see meaningful social and financial returns.

Fertile Soil | Market Movement in Africa

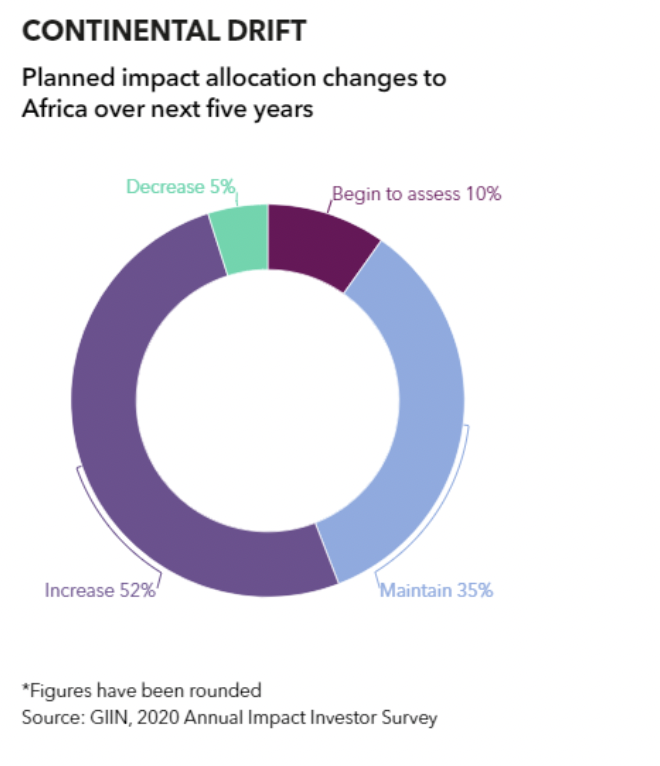

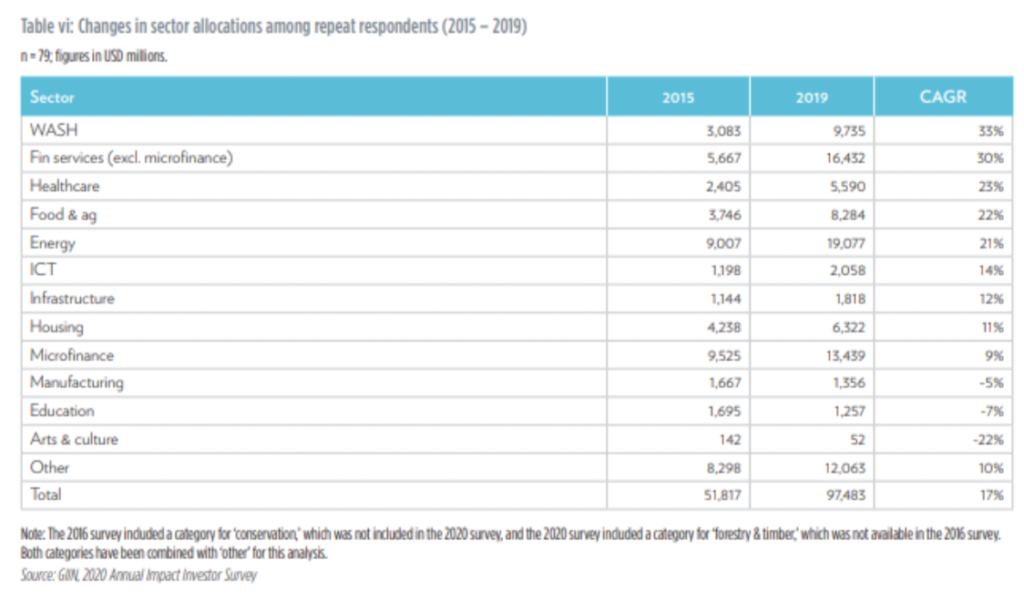

Over the decade there has been a clear growing trend towards impact investing specifically in Africa. The overall value of impact assets under management has been growing at a compound annual growth rate of 9% for the past 5 years, and the current size of the market sits at an estimated USD 715 billion.

The evident market opportunity and large social need is expressed by the share size of the opportunity and the growing allocation in developmental sectors, while at the same time accounting for the diverse market and geography. With a steadily growing population heading towards 2bn, Africa’s 1.1bn workforce will be the world’s largest by 2040. Equally, with a collective GDP of $2.6 trillion by 2021 and $1.4 trillion of consumer spending, many have seen the impact of around 500m new middle class consumers. Africa as a continent has, on average, grown its economy at 5% per annum over the last decade. It is already as urbanized as China and has as many cities of over 1m population as Europe.

In fact the next billion dollar market is in Africa which possesses a new youthful consumer base readily engaging with the digital world but waiting for appropriate products or services to reach them. Recent activity in the market, especially in financial inclusion and technology, indicate a market ready to work with a global audience and African businesses with the ability to serve a diverse range of products and services to a wider group. Notably since 2015 CEO’s such as Jack Ma, Jack Dorsey and Mark Zuckerburg to name a few have begun partnering with Africa ventures.

At the same time Africa has seen the increased physical presence of these tech giants with Google’s first AI lab in Ghana and Amazon’s data center in South Africa. In addition, exciting strategic partnerships indicate wider access for young Africans as seen with Visa’ partnerships in 2019 with MFS Africa, a partnership that enables mobile money users on MFS Africa’s network to access a virtual Visa card for e-commerce and remittance transactions as well as Visa’s partnership with Paga, an arrangement that allows Paga account holders to transact on Visa’s global network. Partnerships such as these will also see both companies work together on tech, signaling increased opportunities for equitable partnerships across the continent.

All these developments and trends are an indication of a continent seeding on fertile ground.

Reaping the Harvest | The Role of LPs and Significant Stakeholders

Though, every promised-land requires LPs ready to take alternative steps and make significant contributions to the impact investing landscape in Africa,Brookings Institution estimates that impact investing in Africa is nowhere near reaching the scale or investment opportunity required to reach the continent’s development needs. It is estimated that Africa requires an additional 256 billion a year in financing to reach the 2030 SDG goals.

In order to reach this ambition, LPs will need to have a mindset of longevity, each nascent market requires time and a steep learning curve to achieve exponential growth. Although there have been notable exits in Africa (Jumia’ IPO and Paystack’s acquisition by Stripe ), it cannot be said that all businesses in Africa will resemble tech savvy platforms with exceptional IPOs. The financial markets have not developed in that way and likely only key markets such as South Africa, Nigeria and Kenya can provide an environment for such transactions. Therefore having a patient building- block approach for value to be unlocked is what is required.

In order to reach this ambition, LPs will need to have a mindset of longevity, each nascent market requires time and a steep learning curve to achieve exponential growth. Although there have been notable exits in Africa (Jumia’ IPO and Paystack’s acquisition by Stripe ), it cannot be said that all businesses in Africa will resemble tech savvy platforms with exceptional IPOs. The financial markets have not developed in that way and likely only key markets such as South Africa, Nigeria and Kenya can provide an environment for such transactions. Therefore having a patient building- block approach for value to be unlocked is what is required.

Furthermore, the concentration of market activity in impact investing is still in a few countries representing the largest transaction value. To have a meaningful impact LP’s have to consider other untapped or unseen markets in countries with significant developmental challenges. Impact investing in Africa requires radical thinking and alternative tools relevant to those businesses and the context of those investments. As a matter of fact the generic African SME will have minimal capital requirements, be physically intensive while making a modest revenue and growing organically within a specific geography or region. Those businesses too are important in developing the engine in Africa as future employers and innovators. Funds such as African Trust Group focus on female lead business in “riskier countries” by supporting them with relatively small bespoke-structured tickets of roughly USD20 000- 50 000 and helping them unlock their local markets. Such funds should also be included in the strategy of impact investing in Africa. Capital in the early and growth stage of businesses is essential and represents one of the underfunded segments in Africa. LPs can select funds that focus on working with early-growth stage businesses that need agile capital with the ability to support unlocking different markets or to support swift pivots in response to dynamic market changes.

Importantly, African investments without on-the-ground African investment managers (not only as investment officers but as owners in the fund too) will always have limited impact. New LP’s outside of Africa considering impact investing in Africa need to have trustful conviction; courageous enough to extend a hand to a different cultural experience, while understanding that local problems can truly be solved through local solutions. GPs with proven track-records in Africa, with African investment background are part of that impact story. LP’s can contribute through their asset allocation to the engine that fuels the next generation of Africa wealth.

The Shift | Conclusion

The soil is ripe for the development of the impact story in Africa. The opportunity is immense with the surface barely scratched. International LP’s are positioned to seize the momentum of the impact narrative in Africa, what is required is perspective, with the courage to manage risk and with ability to understand that Africa is vast and infinitely diverse. Changing your perspective can change your experiences and open opportunities in nascent markets.

Danai Musandu is the Senior Investor Relations Associate at HPE Growth. In her role, she leads and supports the public and investor relations function. Her work involves fundraising and strategic communication both internally and externally.

Prior to HPE Growth, Danai spent six years as an Investment and then Investor Relations Associate at an early-stage technology private equity firm focused on emerging markets and impact investing.

Danai holds a BCom in Politics, Philosophy and Economics and a postgraduate honours degree in Economics from the University of Cape Town. She is an in-house mentor for various initiatives and sits on the advisory board of African Trust, a fund committed to investing in Africa’s female entrepreneurs. In addition, she contributes to the University of Cape Town Graduate School of Business and Oxford MBA Executive Impact Investing Course and sits on the advisory board of Private Equity International.

Bibliography

Bright, Jack. “Visa partners with Paga on payments and fintech for Africa and abroad.” Techcrunch, Techcrunch, 2020, https://techcrunch.com/2020/03/08/visa-partners-with-paga-on-payments-and-fintech-for-africa-and-abroad/?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAANQrYMus93xa2niXEaV_B29iCmrxuhyql3ndcZXnEY4MaFdoS_Qan9gDrD9U1GBiqyPBME. Accessed 5 August 2021.

Future Agenda. “Future Agenda.” Africa Growth, 2020, https://www.futureagenda.org/foresights/africa-growth/. Accessed 05 August 2021.

GIIN. “Annual Impact Investor Survey 2020.” Annual Impact Investor Survey 2020, vol. The Tenth Edition, no. 2020, 2020, p. 7.

Keyes, Daniel. “Visa is partnering with MFS Africa to expand mobile money’s reach.” Insider, 2019, https://www.businessinsider.com/visa-partners-with-mfs-africa-2019-12?international=true&r=US&IR=T. Accessed 5 August 2021.

Hero image created by Rentschler.Digital