Description

List of 3 single family offices from Europe that invest in Private Equity

In the following, we introduce you to three interesting European family investment groups that invest in private equity deals. Many family offices are now important investors in the field and hence important contacts for M&A executives, CEOs as well as fund managers. All family offices are part of our extensive private equity family office list.

1. Baltisse NV (Gent, Belgium)

In 2007, Filip Balcaen founded Baltisse after selling the family’s wall and floor covering firm Balta Group to British PE investor Doughty Hanson. Since then, Baltisse is one of the most important Belgian family office investors. Main asset classes are private equity, real estate and capital markets. For the pE investments, the firm invests in the industrial sector, consumer goods, health, services and energy. Important for the firm are competitive market positions and EBITDA ranging from €5-50M. The firm has a strong regional focus on Belgium and the Netherlands. Possible deal types are growth investments, MBOs and MBIs as well as shareholder replacement. Exemplary investments are Polflam, House of Talents and Origis Energy.

2. Souter Investments (Edinburgh, Scotland / UK)

The Scottish family office Souter investments is a major PE investor in Europe. The firm manages the capital of Sir Brian Souter, who launched Stagecoach group. The current portfolio value lies at £250M. Investments are Ashtead Technology, cilmatecare or Virgin mobile. The firm is sector agnostic and invests in a wide range of transaction types, like MBOs, MBIs, BIMBOs, growth investments, carve-outs or balance sheet restructurings.

3. Syngroh (Schiltach, Germany)

Grohe is a major German firm for sanitary fittings. The firm was launched in 1936 by Friedrich Grohe and realizes more than €1BN of yearly revenues today. In recent years, the family created a dedicated family office for private equity investments, called Syngroh Adivsory GmbH. The firm wants to offer its expertise, network and capital for medium-sized firms with compelling products and services. Targeted enterprise values range from €10-50M.

European Private Equity Family Investment Groups

Many European high net worth individuals (HNWI) and wealthy families gained their wealth by building industry-leaders. Often they are owners of huge family holdings that dominate global markets. Using Single Family Offices they are leveraging their entrepreneurial expertise and invest in medium-sized companies. Thus, Private Equity is an important asset class for many SFOs.

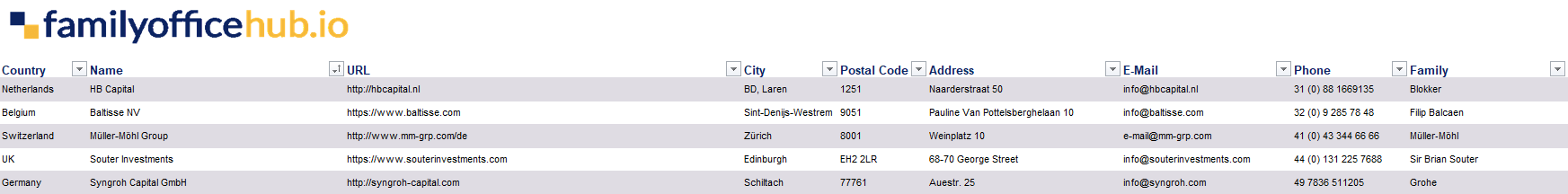

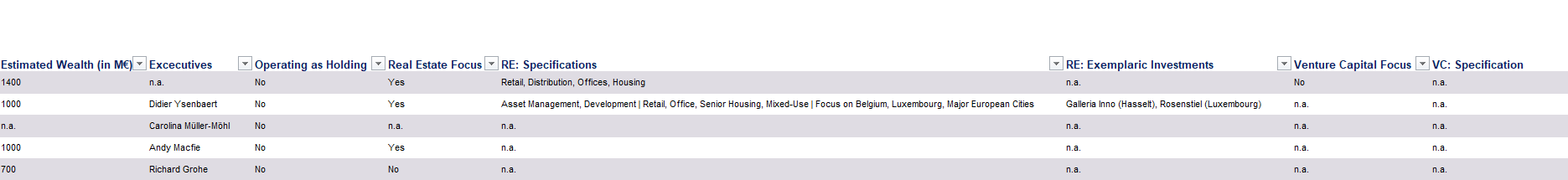

+23 columns of valuable information

We build our lists to ensure optimal usability for our clients. There are three areas included: family information, contact details and investment information. So we provide you with general e-mail addresses, phone numbers, excecutive names, exemplary investments and many more features.

Disclaimer: due to the secrecy of some family offices, we are sometimes not able to provide you with email addresses or other pieces of information. In case we don’t know the exact investment focus, the specific column is marked as n.a.

Database of Private Equity Single Family Offices

Private equity is in today’s low-interest landscape one of the most beloved asset classes of Europe’s single family offices. We are offering a unique database of the most important single family offices investing directly in private equity. The investment firms of the high net worth families engage in three different ways in private equity: as direct private equity investor (like a regular fund), as a holding of the family companies and acquired firms in related areas or as an indirect investor in funds or PE firms. This database focuses on the first two categories. Single family offices who invest in PE funds can also be found in our whole database of Europe’s single family offices.

Investment types: fund investments, direct investments, holdings

As mentioned before, there are three different ways how family offices are doing private equity investments. The first one is acting like a private equity investor. The firm has a dedicated investment focus and is actively acquiring companies. Transaction types and situations (from growth to restructuring) vary widely. These single family offices are led by experienced private equity professionals who formerly worked for leading PE funds. The second category is often the case when the family office is serving as holding for the family companies: there is no communicated investment focus, but the holding is interested in companies related fields to the family business. The third way is investing indirectly in funds as limited partners (“LPs”). Investors in funds can also be found in our complete European single family office database.

Drivers for family office investments in PE

The reasons why SFOs invest in private equity are different. When we talk to single family offices we most often hear that more and more family offices are looking at PE investments because of the higher returns in comparison to other asset classes. With well-managed private equity investments, returns over 10% are still possible, which is hardly achievable in capital markets. For that reason, an increasing share of Europe’s single family offices build up own private equity divisions and employ PE professionals from leading funds like KKR, Carlyle or Ardian. Another reason is that many SFOs want to bring their experience and market power from their family business into new ventures. This is especially often the case for German single family offices who made their fortune through mid-sized “Mittelstand” companies which are market leaders in their field.

How our list helps you to identify the right single family offices

Our list of private equity single family offices has already helped many firms. The listed single family offices are owning many companies with billions of euros in revenues and are active investors in Europe’s private equity industry. The list offers many different data points (if publicly available): from contact details (like emails, phone, address, website, etc.) to details about the family (name, wealth, etc.) to a detailed investment focus. In the investment focus columns we state everything we know about the respective sfos: from asset classes, transaction types to exemplary investments and holdings.

Industry knowledge, market insights and exclusive reports

Within the last couple of years, our research team has been able to build unique knowledge about single family offices and the private equity industry in Europe and beyond. We do not only update and extend our database of European single and multi family offices on a regular basis, but also report about current trends in the industry. Thus, you are able to get valuable insights about various topics in the family office environment. For example, we recently published an article named “How Private Equity Funds and Single Family Offices work together in Europe”. You can read about the three main areas of coopertion, namely co-investments, fundraising and company exits. We also demonstrate the role of single family offices within the European private equity market, by digging into specific industries.

Picture source: Bruno Abatti, Connor Mollison

R.S. (verified owner) –

We are currently structuring a list of potential clients for an industrial succession case. This list helped us to identify relevant families, especially in the German-speaking region. Some of them are classified as “Holding of companies”. These firms are harder to match in our case. Anyway, top list