Description

List of 5 large Multi Family Offices in Europe

Multi family offices play a major role in the European investment landscape, managing billions of euros of capital. We are introducing you to five major family offices from our European family office database.

1. Square Capital (UK, France, Monaco)

The London-, Paris- and Monaco-based asset management firm Square Capital is focused on families and UNHWI’s. The multi family office was launched in 2007 and now has over €1.5BN assets under management and advisory. The family office invests in equities, fixed income, hedge funds, commodities, as well as private equity, venture capital, real estate, farm land and private debt.

2. Stanhope Capital (UK)

Interestingly, London-based Stanhope Capital nowhere calls itself a family office. However, the “wealth management and advisory” firm is one of Europe’s most-renowned multi family offices with more than USD 24 billion under management. In 2020, the firm announced to merge with FWM Holdings. FWM is the parent company of the Forbes Family Trust, whose owner family is known for its publications. Clients of Stanhope include the Duchy of Lancaster, which is the private estate of the Queen. Stanhope differentiates its services in Wealth Management, Consulting, Merchant Banking and Private Investments.

3. 1875 Finance (Switzerland)

The Swiss multi family office 1875 manages more than CHF 13 billion of assets through 4 offices and 65 employees. The firm was founded in 2006. Amongst the founders were Jaques-Antoine Ormond and Francois-Michel Ormond, whose wealth management roots go back to 1875. The family office is based on Swiss-typical high confidentiality and long-term financial planning.

4. UBS Global Family Office (Switzerland)

The Swiss private bank UBS belongs to Europe’s leading financial institutions with over USD 1.1 trillion of invested assets. Its family office unit “UBS Global Family Office” is well-known and heavily expanding throughout the last few years. The family office offers its client mainly investing services. It separates its services in four major fields: “Core Business”, “Investment Portfolio”, “Strategic Investments” and “Financing”. For example, it helps the family businesses in M&A cases, corporate financing and capital market topics. In its investment division, it offers trading and infrastructure services as well as “tailored investment solutions”. Also private deals in real estate and private equity are part of UBS’ family office strategy.

Update 2023: In Luxembourg, Stanhope agreed to merge with Arche Associates to expand its Benelux operations. The firm oversees more than $2.5BN of aggregated wealth. Together, the multi family office manages more than $29BN.

5. HQ Trust (Germany)

Out of the single family office of the German Harald Quandt family, the well-known HQ Trust multi family office was created. The multi family office invests on behalf of its wealthy family clients in different asset classes, amongst others equities, debt, real estate and private equity.

Picture source: Claudio Schwarz

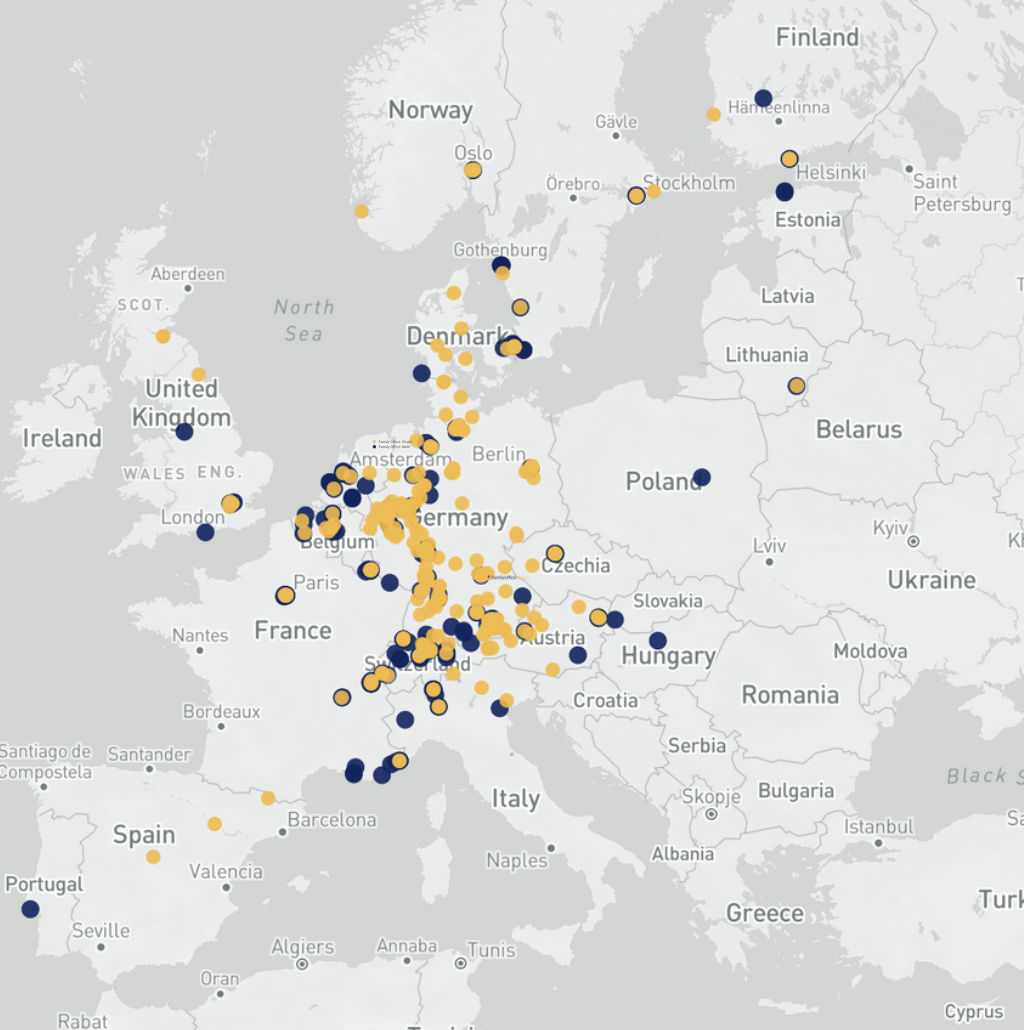

Location of Europe’s Multi Family Offices

Europe’s multi family office investment firms are widely spread throughout the continent. Home to most multi family offices is Switzerland, with more than 150 major multi family offices. Especially important are wealth management clusters in Zurich or Geneva. Another important country for multi family offices is Germany with over 100 firms. Germany offers important financial centers like Frankfurt or Munich. Of course, also many UK multi family offices are included in the list.

HNWI investment landscape in Europe

As one of the richest continents, Europe plays a predominant role when it comes to wealth and wealth management. Many wealthy entrepreneurial families are relying on multi family offices, which are pooling the assets of multiple families. Investments are done through external asset manager, own funds or alternative investments.

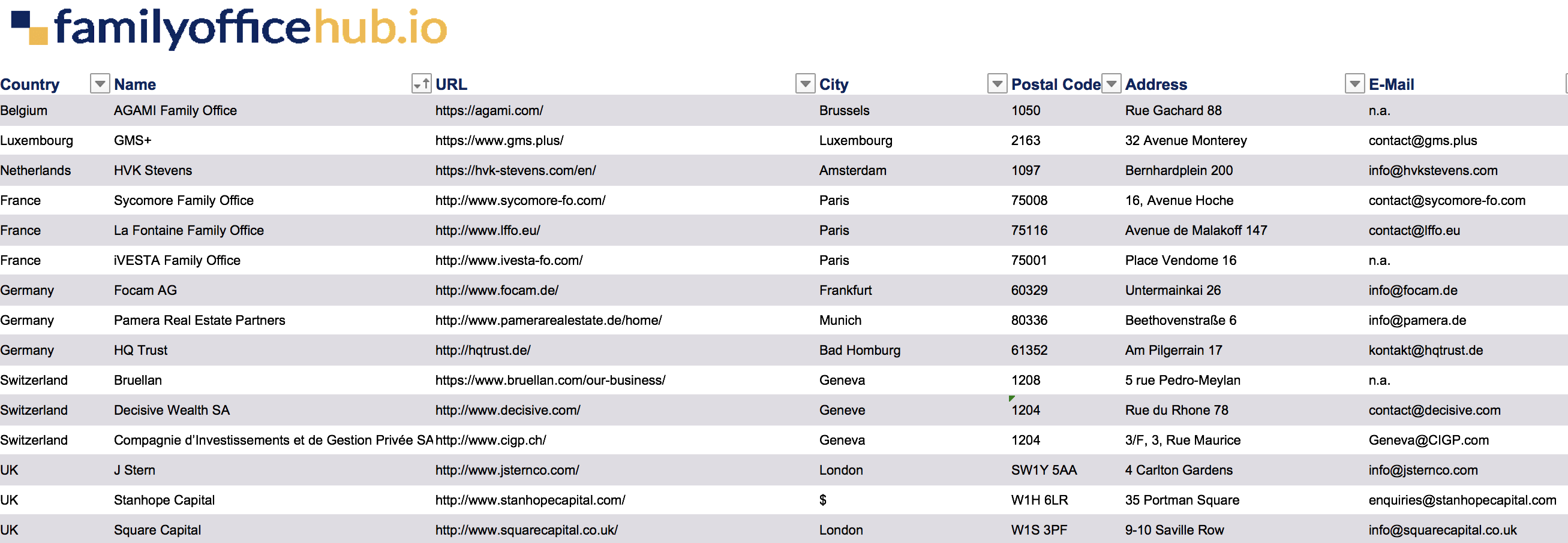

+17 columns of valuable information

We build our lists to ensure optimal usability for our clients. There are three areas included: family office information, contact details and investment information. So we provide you with general e-mail addresses, phone numbers, excecutive names, type of family office (asset management / consulting / bank affiliated).

Interested, but you want more? Get a preview file with exemplary entries.

You can directly download a preview file at the multi family office list preview product page. In case of any remaining questions or if you want an individual preview file drop us a line via email or live chat.

What type of data is included in our list

- Contact details (address; telephone number; e-mail ; executive board)

- Subdivision by focus (asset management; consulting in asset structuring; bank-related services)

- An additional focus of MFOs, if applicable (real estate; private equity; yacht management; sports management etc.)

London, Frankfurt, Geneva, Monaco and Co

The old continent is a powerhouse when it comes to wealth management. Many successful companies made their owners rich and created wealth which now has to be protected and managed, to retain and increase its value over time. Billions of Euros must be managed and invested properly across the world and the continent. The offered database covers all financial centres but also smaller cities and second-tier finance hubs, providing an extensive overview of the Family-Office Industry. Based on our years of experience we were able to include information missing in our competitor’s lists, providing further added value to our customers. Using this database helps you to generate leads and reach out to the contacts that matter most to your success.

The whole world has its finances managed by European multi family investment firms

The listed Multi-Family Offices serve clients not only in their home countries, but also in other countries, especially when coming from a financial hub such as Monaco, Switzerland or Luxemburg. But not exclusively European families rely on the services of such Family-Offices. Wealthy families for example from the United Arab Emirates, Saudi Arabia, Qatar, or even China or India also rely on the services offered in Europe. We include all types of family offices from a niche-boutique office until huge operations, which manage several billions of Euros on behalf of their local or international partners.

Thomas Myers –

Bought the list to enter the European family office market with our firm.

Good contacts, hassle-free download.

5/5

Benjamin E Catling –

Great database for such a inconspicuous market. Very helpful to my cause. The best data I’ve seen on familly offices, still not a perfect data set but continually being updated.

Customer service was super helpful and worked within seconds when I made a mistake with my order to help resolve. very impressed!

Kreft Advisory, Zürich – Family Office Services and Corporate Finance –

Global, and a highly structured methodology perfectly aligns with our approach. The information is presented with the right precision, and with the right nuance in a fuzzy data environment. It is the best and most comprehensive list we have seen so far. The team of FamilyOfficeHub is motivated and helpful.