This article belongs to our exclusive single-family office guidebook, where we give guidance on the most relevant topics for newly established and already existing family investment vehicles. It was contributed by Maor Investments, a leading Israeli technology co-investment fund.

Over the past 3 decades, and more dominantly in recent years, Israel has positioned itself as an international technology hotspot, covering a wide scope of innovation themes: from drip irrigation, through the Disk-On-Key, and all the way to the firewall and Waze navigation, Israeli technologies have led disruptive changes in various industries, influencing the daily lives of people around the globe.

Israel as the “Innovation-Nation”

Once famously coined the “Start Up Nation” – to reflect a reality of small companies with brilliant ideas, quickly sold to global market leaders – Israel has now become the “Scale Up Nation”: as the industry matured, Israel is now capable of building and sustaining strong, long-lasting sizable technology companies. This is true in the private market – Israel actually tops the world in number of “Unicorns” (private tech companies valued at more than $1bn) per capita – as well as in the public market, with Check Point, Wix, Fiverr, SolarEdge, Nice and Playtika, just to name a few of the listed Israeli tech companies which are considered market leaders in their specific niches.

Why family offices should keep an eye on Israeli startups?

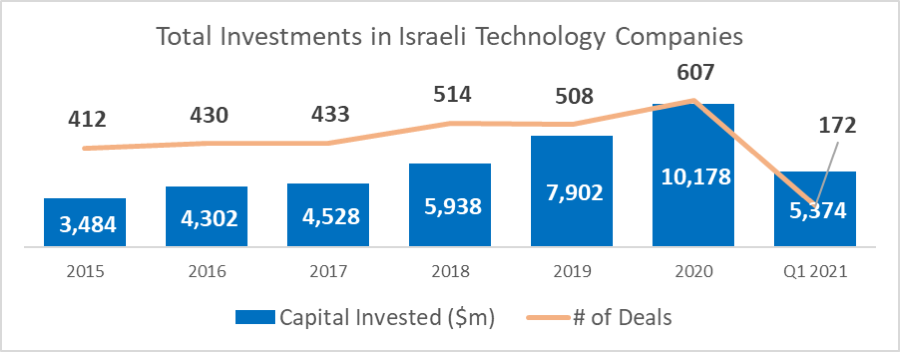

Source: IVC-Meitar Israeli Tech Review

The opportunity Israeli technology presents to investors did not go unnoticed. From 2015 to 2020, the capital invested in Israeli technology nearly tripled (with 2021 being on route to be double the size of 2020). Indeed, with technology emerging as a differentiated assets class globally, investments in technology have also substantially increased during the same period all around the world; however, it is important to note that not all technology companies are born equal: even within this larger frame, the Israeli market stands out with its one-of-a-kind ecosystem for successful technology companies:

- Unique Culture – Israeli business and technological acumen is based on an agile, solution-oriented approach, along with old-fashioned Chutzpah, bringing Israeli companies to tackle challenges, along with the capability to adjust according to the changing dynamic environment.

- Unparalleled Investment in R&D (Research & Development) and Workforce Availability – for more than 20 years, Israel constantly leads the OECD in R&D spending as % of GDP, and it currently ranks #6 globally in availability of scientists and engineers. This, along with additional experienced personnel arriving from the defense establishment (following mandatory military services), means Israeli companies have a healthy access to top-tier local workforce.

- Strong Access to the Global Market – With a negligible local market, Israeli companies are focused on global expansion from Day-1, usually with assistance of the powerful backbone of Israeli tech communities in the largest hubs in the US; Israel is also home to more than 500 multinational corporations with presence on the ground, giving local companies an exposure to potential partnerships, as well as clear M&A opportunities later down the road.

- Established Financial Backing – Israeli offers diversified financing routes for startups, starting from government support (by the Israel Innovation Authority, mainly to early-stage companies), through local VCs and all the way to local offices of the top international investor.

This unique breeding ground constantly generates groundbreaking technology companies and sets an opportunity for family offices to gain exposure to top-tier private technology assets, which in many respects are decorrelated with other investment strategies and asset classes.

About the author of the article

Maor Investments is a venture capital fund focused on growth-stage Israeli tech companies. With European roots, and boots on the ground in Israel, Maor enjoys a strong multicultural and multifunctional team, well-established at the heart of the Israeli tech ecosystem. Maor provides its investors, mainly family offices and HNWI, with a unique investment vehicle, wrapped in European LP-friendly setup.

Contact Details:

9 Rue de Bitbourg, Luxembourg L-1273, Luxembourg

28 HaArba’a St., Tel Aviv 6473927, Israel