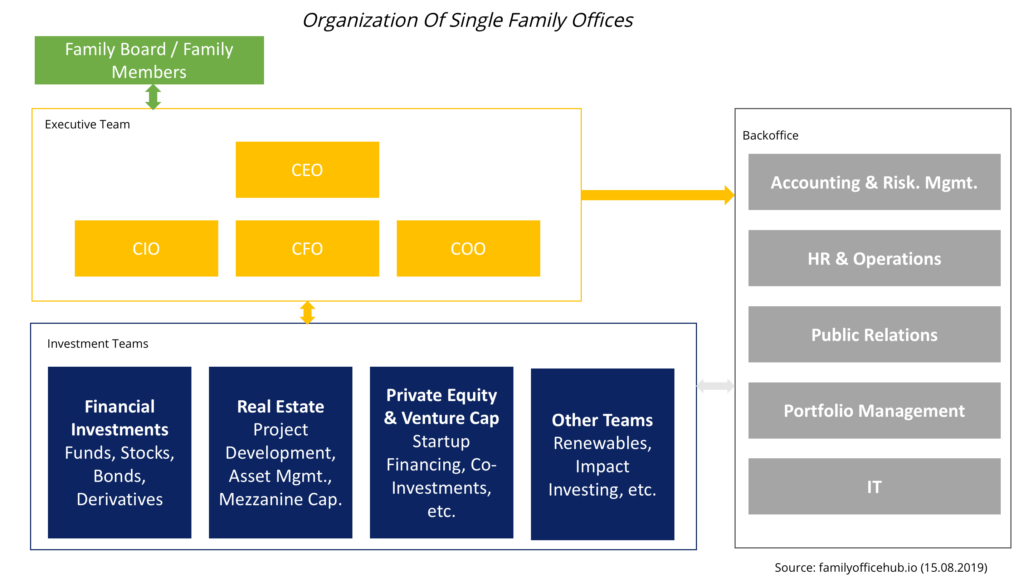

When launching a single family office, the executive positions are key hires. How many executive positions are staffed heavily depends on the size of the family office. Larger single family offices with billions of assets under management require a larger executive team than a $50M single family office which might work with only a CEO and a handful employees. In this article, we introduce you to the possible executive positions in family offices.

Chief Executive Officer (CEO)

The CEO serves as the head of the single family office – and is usually the first hire. The CEO reports directly to the family members and makes sure that the SFO follows its strategy and – most importantly – preserves and increases the family wealth. The CEO manages the family office and is in touch with every team: from accounting to investment management. The CEO decides about prospective deals and investments – either alone or together with family representatives. The involvement of the CEO in deal sourcing and investment management depends heavily on the size of the family office. In larger SFOs, every asset class has its own responsible investment director. In smaller SFOs, the CEO also deals with the investment management process. Usually, the family office CEO has vast executive experience and either a finance or legal background. Often, CEO candidates at family offices also have degrees from prestigious Ivy League universities like Harvard or Yale. In many cases, the single family office CEOs are well-known to the family. Either as the trusted family lawyer or a long-time executive at the family company.

Chief Investment Officer (CIO)

The CIO is – as the name suggests – responsible for all investment-related topics at single family offices. He is responsible for deal sourcing, investment management and asset management. The CIO tasks start with determining the investment strategy and afterwards to make sure that the SFO successfully follows the strategy. Usually, CIO have previously worked for investment banks, private equity firms or other family offices. CIOs have a solid track record and extensive experience in various asset classes. Together with the CFO, the Chief Investment Officer is also responsible for risk management and reporting. Especially direct investments (private equity / venture capital / real estate) have to be constantly tracked. When working with external asset managers, the CIO is heavily involved in beauty contests and the final decision of which asset managers to work with. The CIO is usually well connected with investment executives from other firms and thereby able to source off-market deals and co-investment opportunities.

Chief Financial Officer (CFO)

The CFO in single family offices is responsible for all accounting-related topics. The CFO is mainly responsible for the tax returns of the family members, as well as for the company structure of the family office. Often, this can get highly complex, when family members live in different countries or tax-vehicles are used. Together with the Chief Investment Officer, the CFO also works on tax-efficient investment strategies. Furthermore, the CFO is responsible for cash flow reporting and financial statements. A main point handled by the CFO is also the liquidity management: profits of the family office have to be steadily distributed to family members. On the other hand, payable bills and financial obligations are also met by the CFO. Usually, the CFO has multiple years of executive experience and worked for the Top 4 consulting firms.

Chief Operating Officer (COO)

The COO in single family offices is responsible for all non-investment tasks. The day-to-day business of a family office is overseen by the COO: this ranges from hiring staff to making sure that risk management is done properly. The COO works on budget planning and helps family members with private projects (like starting a foundation). The COO is also responsible for smooth processes and regular reporting. Usually, the COO brings years of management experience and has a finance background.

Picture Source: Xiang Gao

This article belongs to our “Career At Family Offices Section“.

Relevant Single Family Offices That Are Hiring Executives

-

Rated 4.63 out of 5€999,99 including VAT