Description

List of 3 single family offices from Singapore

In the following, we are introducing you to three interesting Singaporean single family offices that invest in various asset classes. We focus on the family offices and their investment style.

1. Tsao Family Office

The Tsao family manages its assets and invests through the Tsao Family Office. The investment focus is on global equities, fixed income products as well as private markets, for example in private equity, credit and real estate. Furthermore, the family office is also active in philanthropy.

2. Rumah Group

The Rumah Group is an exciting Singapore-based family office that cares about sustainable business and is active in philantrophy. The asset management division of the Singaporean family offices invests mainly in equity and real estate investments. Furthermore, Rumah is a strategic investor in GYP Properties Limited. Furthermore, Rumah is active in the field of impact investments and wants to tackle resource degradation and the impact of climate change. In addition, Rumah actively supports non-profit work and is thereby a good example for the valuable work of many family offices.

Update 2023: Rumah confirmed its role as active single family office from Singapore with an investment in December 2022. It joined other investors, such as energy firm ENGIE, in BillionBricks $2.45M seed funding round.

3. Sassoon Investment Corporation

The Sassoon family from Singapore manages its wealth through the Sassoon Investment Corporation (SassCorp). SassCorp is active in various fields: consumer brands in Asia, with focus on luxury and lifestyle retail, education, real estate development and asset management as well as technology. For the technology part, SassCorp invests in FinTechs, MedTechs, AgroTech and LogTech. Furthermore, SassCorp invests in venture funds. Its philanthropy is organized through the Sassoon Foundation Charity.

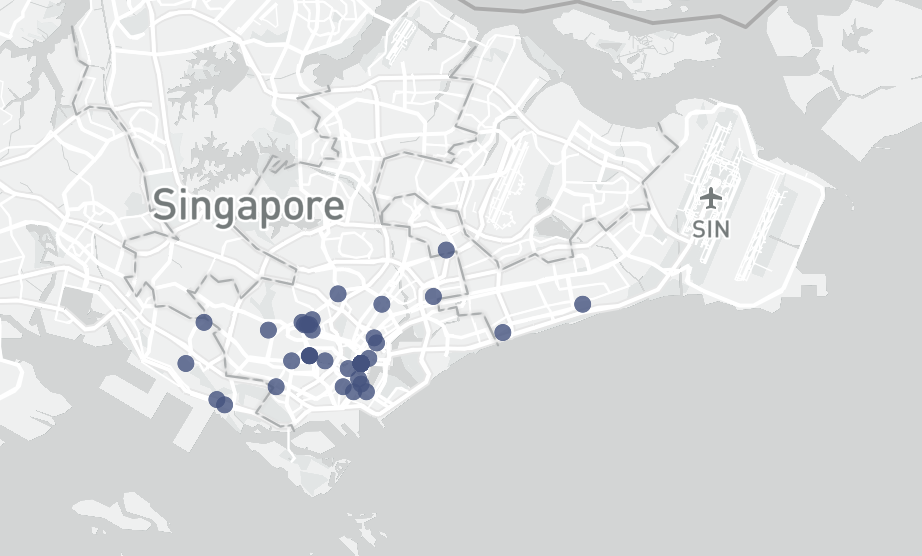

Location of the Single family offices in Singapore

Singapore is a city state in south east Asia. It is an international banking hub were many of the world’s leading banks have their Asian offices. So it is no surprise that single family offices are also located there.

Our database of the largest single family offices in Singapore

Singapore is one of the most important single family office centers in Asia. According to a report of The Business Times, the number of single family offices rose to about 200 in 2020. The total assets under management might be more than $20BN. The family offices are an important factor in Singapore’s and Asia’s business and investment sphere. Our list of the most important single family offices in Singapore covers a large percentage of the 200 active family investment vehicles.

Important family investment vehicles from Singapore

Singapore is one of the richest countries in the world. That has several reasons: the thriving technological sector, the free-trade environment fostered by the government, the state’s focus on economic development. In total, Singapore has 44 billionaires – and many of them run their own single family office. Single family office invest the wealth of HNWIs in various asset classes, like real estate, financial markets, private equity, venture capital or other alternative assets.

Why we offer the best overview of family offices from Singapore

Our research team has spent years identifying the most relevant Singapore’s single family offices and collecting them in our internal database. For our research, various channels are utilized: network research, transaction investigation, web crawlers, press releases, etc. Our team has several years of experience in the family office sector and is well connected. Our European single family office database or American single family office database are highly-regarded products in the global investment and family office community.

High data quality through in-depth research

We offer the most datapoints and the highest data quality: every single family office we add to our list is manually checked by our research team. We gather as much information as possible and take care on carefully selecting the most relevant and largest single family offices. Thereby, our customers receive a high-quality list of Singaporean single family offices.

Disclaimer: due to the secrecy of some family offices, we are sometimes not able to provide you with email addresses or other pieces of information. In case we don’t know the exact investment focus, the specific column is marked as n.a.

Why we offer the best Singaporean family office directory

Useful data in our single family office directory: investment focus, family wealth, exemplary investments

Our customers especially value our various data points: besides contact details (general e-mail address, phone number, URL, address) executive names, family wealth, we also include many information points about the detailed investment focus. Especially, we provide you with details on the real estate, private equity and venture capital investment focus. We specify the investment style (in which kind of companies or real estate does the family office invest?) and we provide you with exemplary investments. The list can also be filtered and sorted by financial market investments (funds, equities, etc.) and renewable investments.

Laure Sohmekh (verified owner) –

Thank you for the nice business support