-

Rated 4.63 out of 5€999,99 including VAT

-

Rated 5.00 out of 5€349,99 including VAT

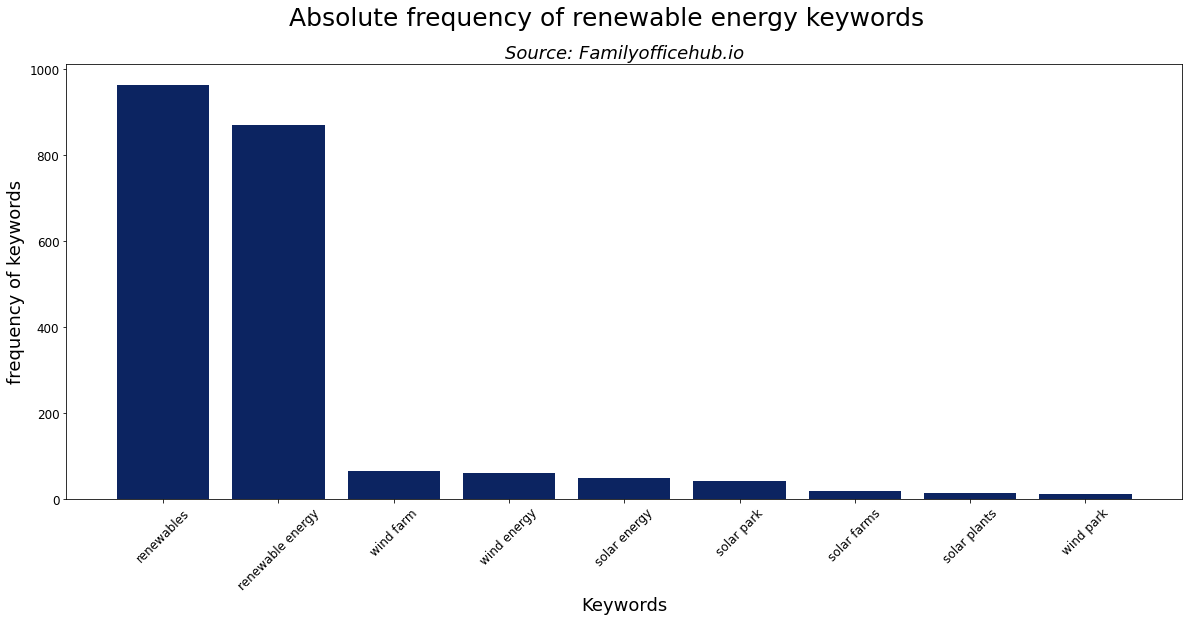

We created this article as part of our research process for our European single family office database. We used our keyword crawler to analyze the websites of EU family offices for renewable energy keywords, such as “solar energy” or “wind parks”.

You might also like the lists of the list of the 500 largest renewable energy developers in Europe or the list of the 350 largest renewable energy investors in Europe, curated by our partner portal renewables.digital.

Investments in renewable energy infrastructure are essential for the energy transition, which is necessary to reduce global warming. Also family offices, the investment vehicles of wealthy families, are increasingly investing in solar parks and wind farms. Through a detailed crawler-based analysis, the familyofficehub.io team identified that the number of European single family offices mentioning renewable energy on their website is steadily increasing. As of July 5th, 2023, 69 single family offices are mentioning renewable energy keywords on their website. Compared to December 2022, where only 66 family offices where mentioning the same keywords, that’s a 4% increase. Based on our database of 839 European single family offices, the 69 SFOs mentioning keywords like “solar energy” or “renewables” correspond to a share of 8.3%.

Investments in renewable energy infrastructure are essential for the energy transition, which is necessary to reduce global warming. Also family offices, the investment vehicles of wealthy families, are increasingly investing in solar parks and wind farms. Through a detailed crawler-based analysis, the familyofficehub.io team identified that the number of European single family offices mentioning renewable energy on their website is steadily increasing. As of July 5th, 2023, 69 single family offices are mentioning renewable energy keywords on their website. Compared to December 2022, where only 66 family offices where mentioning the same keywords, that’s a 4% increase. Based on our database of 839 European single family offices, the 69 SFOs mentioning keywords like “solar energy” or “renewables” correspond to a share of 8.3%.

Renewable energy as investment opportunity for family offices

Family offices like Atlas Invest – the investment vehicle of Marcel van Poecke – are increasingly investing in renewable energy verticals. The Belgium family offices is based on van Poecke’s refinery business. The family office traditionally invested in conventional oil E&P, downstream and midstream companies. However, today there are a number of renewables focused investment in Atlas Invest’s portfolio, e.g. Emergya Wind Technologies, which works on wind turbines. Furthermore, Atlas Invest is also backing Aukera, which calls itself as “large-scale technology agnostic renewable energy developer and investor”. The firm is currently developing ofer 517MW onshore wind projects and 5,250MW of solar projects, as well as 733MW storage projects. Another major renewable energy-focused family office is the Munich-based Arvantis Group, the Alexander Samwer family office. The firm invests in the renewable energy field through Pelion Green Future, a clean energy and sustainability-focused investment holding. Pelion, in turn, backs firms like Pacifico Energy Partners, Boom Power or Solparc. Another major family office in our list is Wirtgen Invest, which is building up a large-scale renewables portfolio in Europe. In December 2022, ABO Wind announced that it builds a 50MW solar park in Greece for the German Wirtgen family office.

In the following plot, we are listing the keywords from our analysis.

Picture source: Andreas Gücklhorn

![European single family offices are shifting to renewable energy [2023]](https://familyofficehub.io/wp-content/uploads/2023/07/Bildschirmfoto-2023-07-05-um-18.28.36.png)