In our new article series, we introduce the most exciting venture capital firms that are open for LP investments to our family office network. The article belongs to our exclusive single-family office guidebook, where we give guidance on the most relevant topics for newly established and already existing family investment vehicles.

In this article, we talked to Acrobator Ventures, an Amsterdam and Kyiv-based venture capital fund with a successful proven track record and focused on investing in Russian-speaking founders that are disrupting the B2B SaaS industry

Familyofficehub.io (FO): Briefly describe your focus: in which kind of startups are you investing, where is your geographical focus, what’s your average ticket size?

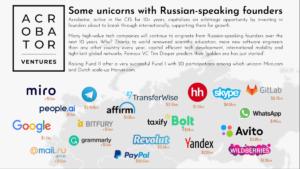

Acrobator Ventures: We are a generalist fund investing in pre-seed to late-seed stage tech companies worldwide that have Russian-speaking founders or founding teams. We focus on Russian-speaking founders since there is a proven track record of successful startups being founded or cofounded by Russian-speaking founders, such as Whatsapp, Skype, Revolut, Miro, Telegram, Paypal, or Google, among others.

We find the next generation entrepreneurs through our inside track and privileged early deal access.

Our first investment tickets go from €100k up to ~€750k. In addition, we are able to operate on a deal-by-deal basis, so we (and our LPs directly) can invest up to €5 mn per deal.

FO: What are exciting companies in your portfolio – and why?

Acrobator Ventures: We are, through our first fund, very early investors in successful companies like unicorn miro.com, a teamwork collaboration platform, and the Dutch HR tech scale-up harver.com as well as regional market leaders like zakaz.ua, travelata.ru, and chocofamily.kz, the largest e-commerce holding in Central Asia.

In our current fund Acrobator Ventures II, an outlier is Studyfree. This platform narrowing the skills gap allows students worldwide to successfully apply for scholarships. Its healthy company growth has already generated a 4X company valuation increase since our investment round only 6 months ago, based on a new investment.

In spite of covid-19, our new portfolio of 4 companies, 50% female (co-)founded, increased ARR by >200%.

FO: Why is investing in startups through Acrobator Ventures a good choice for family offices?

Acrobator Ventures: Our first fund carried out 20 investments and so far delivered 13.3X TVPI and 88% IRR. We have fine-tuned our strategy to ensure repeatable, sustainable returns based on lessons learned. We are properly set up for an ongoing successful track record for consecutive funds. We’re the only truly Western seed fund with a local presence in the CIS region. We are operator-led and very founder focused. We have unique expertise through our growth hack team (15 experts) and our HR and PhD-level Tech venture partners. Last not least, our proprietary “C.A.S.H.C.O.W. B.O.M.B.E.R.” growth system and General Partner Bas Godska’s 10+ years of visibility in Benelux/CIS allow us proven access to the best deals.

FO: Are you also open to investments from European family offices?

Acrobator Ventures: We are pleased to meet European FOs who are interested in diversifying their allocation to a very interesting and harder-to-access target group of companies.

FO: Thanks for your time!

Headquarters: Amsterdam, The Netherlands

Website: https://acrobator.vc/