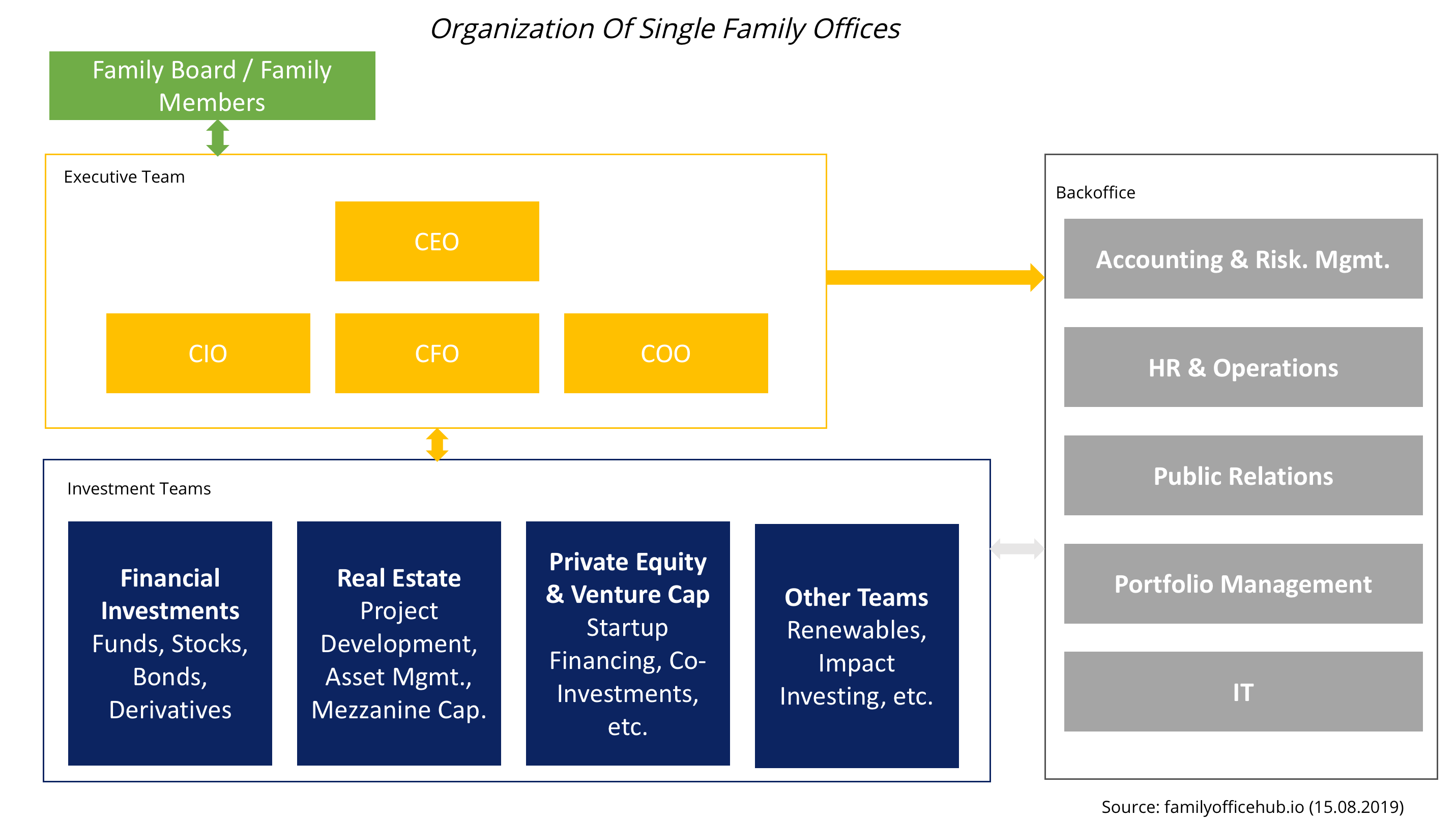

Compared to usual investment companies, single family offices have a unique organizational structure. Single family offices consist of various, large investment teams and only a few back office employees. We give a detailed overview of single family office organizational structures. Many European single family offices follow the introduced organizational structure. Executive Team at our Single... Continue reading →