Description

List of 10 large global Single Family Offices

Throughout recent years, single family offices started playing an increasingly important role on international financial markets. Single family offices are the private investment vehicles of wealthy families. In this article, we are introducing you to three interesting single family offices from our global single family office list.

1. Téthys Invest (France)

In 2016, Françoise Bettencourt Meyers and Jean-Pierre Meyers have set up the French family office Téthys Invest. The Bettencourt family is the largest owner of the major French cosmetics firm L’Oréal. Françoise Bettencourt Meyers belongs to the richest women in the world with an estimated net worth over $75.3BN. Her family office is a really active investor in various markets. For instance, in September the firm ventured into the fashion industry through a minority private equity investment in Sézane, a French label. In June 2022, the firm invested in French hospital group Elsan. However, the Bettencourt family office also invests in funds: the firm is one of the investors of health tech fund Lauxera Capital, which launched a $300M fund in 2022.

Update 2023: In February, the Bettencourt Meyers family office announced a new key hire: former McKinsey partner Cyrielle Villepelet will join the firm as Managing Director to work alongside the CEO.

2. Verlinvest (Belgium)

The Belgian Spoelberch and de Mévius families belong to the richest families in the world with a net worth over $50BN. The fortune of the families is based on the brewery imperium AB InBev. AB InBev realized revenues over $54BN in 2021 and is the largest brewery group in the world. Through Verlinvest, the Belgian billionaire families are pursuing investments in „visionary entrepreneurs“. The evergreen investment fund manages over $2BN of the family’s capital and was launched in 1995. Main verticals for investments are the digital & e-commerce space, food & beverage as well as health & care. Exemplary investments include Gorillas, Lahore, Tony’s Chocolonely, Oatly, Mutti ad Bludental.

3. Grok Ventures (Australia)

Mike Cannon-Brookes is the co-founder of software giant Atlassian. Brookes net worth is estimated at $13.7BN. His personal investments are conducted through his family office Grok Ventures, which participates in early to late stage funding rounds. Indeed, Grok Ventures is a major investor in Australian startups. Recent investments include Dovetail or WeaveGrid. However, the firm is also the largest shareholder of power and gas major firm AGL. In February, Brookfield & Grok Ventures submitted a proposal to acquire 100% of the firm capital of AGL.

4. Awilhelmsen (Norway)

The Arne Wilhelmsen family manages its wealth through the Awilhelmsen family office. The Oslo-based single family office is an active investor in various verticals, ranging from the ownership of the Royal Carribean Group cruise line to the Awilco AS shipping company. The Norwegian family office is also investing in real estate, listed and unlisted equity. The flexible investment mandate for “new industrial investments” of the firm is covered through subsidiary AWC.

5. Raintree (India)

The Indian Raintree single family office manages the wealth of the Dandekar family. The investments of the family office can be split in a for-profit pool as well as a not-for-profit pool for impact investments. The Mumbai-based family office also operates the Raintree Foundation. Portfolio companies include proklean and Grameen Capital India. Proklean, for instance, is a startup from Chennai that works on probiotics, which can be used for industrial applications. The firm announced a $4M funding round, with major participation from the Raintree family office.

6. Weinberg Capital Group (United States)

Cleveland-based single family office Weinberg Capital Group serves as investment vehicle of successful entrepreneur Ron Weinberg, who sold his listed firm HAWK Corporation in 2010. Weinberg Capital is mainly investing in private equity and real estate. Within the private equity vertical, the family office investes in US firms with revenues from $15-100M and EBITDAs from $2-10M. Portfolio companies include Drake Waterfowl Systems and Channel Products. Within the real estate sector, the family office is mainly working in a strategic partnership with the Carnegie-Weinberg joint venture and invests in income-generating properties.

7. Daher Capital (United Arab Emirates)

The UAE-based firm Daher Capital is an important single family office from the Middle East region. The family office actively invests in capital markets, venture capital and private equity. Its capital markets team invests in “defensive industries”. The venture capital portfolio includes firms like SpaceX, upfront or Klaari Capital. The family office also had successful exits through IPOs like FXCM or Stonegate Mortage. Its private equity investments are focused on the consumer, healthcare, education and business services verticals.

8. Prairie Management Group (United States)

The American Segal family office invests its wealth through the Prairie Management Group. The family office invests in different verticals, ranging from private equity to real estate. Within the private equity vertical, the family office pursues direkt investments, like matterport, as well as fund investments like Winona Capital. Prairie is also actively investing in commercial and residential real estate, like a student housing complex in San Marcos, Texas.

9. Sassoon Investment Corporation (Singapore)

The Sassoon family invests through its “SassCorp” in different areas. For instance, the family office is active as brand builder in Asia, for luxury and lifestyle retail. Furthermore, the family office invests in education and technology ventures, especially in the Fintech, Medtech, Agtech and Logtech sector. The family office is also active in real estate development and asset management. In 2023, the family office committed capital to the Genesis Atlernative Ventures Venture Debt Fund II.

10. Wirtgen Invest (Germany)

After selling the family company, the German Wirtgen family established the Wirtgen Invest single family office, which belongs to the most active single family offices in Germany today. Wirtgen Invest invests in renewable energy, real estate, venture capital and capital markets. Besides acquiring some landmark properties in Europe (like 50 Finsbury, London or Wallhaus, Berlin) the family office also belongs to the most active renewable energy family offices. For instance Wirtgen Invest owns several PV plants in Portugal, as well as wind parks in Poland and Sweden.

Picture Source: Benjamin Davies

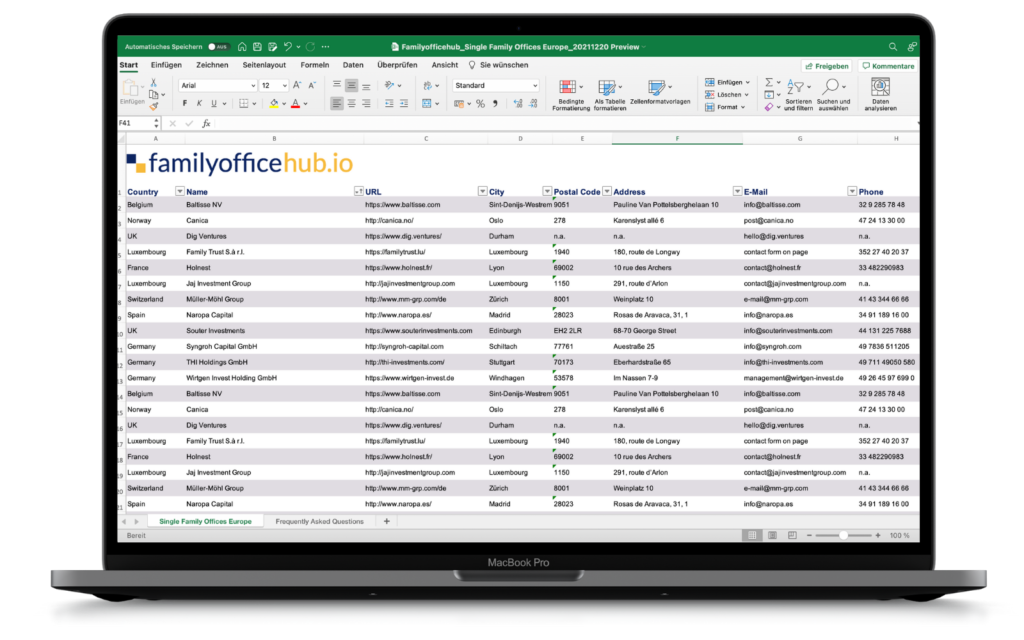

The world’s largest single family offices in one unique list

For years, our familyofficehub.io team analyzed global family office markets. We created lists of the largest European, United States, Asia-Pacific, Middle-East and Canadian single family offices. This list combines all of our available single family office lists in one unique product. The list includes general contact details, investment details, portfolio companies and real estate objects as well as background information (as far as information is available). Our lists are used by leading asset managers, real estate brokers, consultancies, corporates and investment banks to get in touch with relevant HNWI investors. The detailed investment focus helps to get a grasp of the family office’s investment principles and priorities. To understand our lists and the included data, simply request a free preview file at contact [at] researchgermany.com.

Role of HNWI investment vehicles in global markets

More and more families decide to set up family offices to manage their wealth. This makes them increasingly important for different stakeholders in financial markets. First, a large share of family capital is invested through third-party asset managers. So, for every investor relations and fundraising executive it is essential to have a detailed overview of single family office investors. Also, real estate is an important asset class for many family offices. For instance, Amancio Ortega, Billionaire and founder of the Spanish fashion conglomerate Inditex, is one of the most active investors for landmark buildings in all the world. In January 2022, he acquired the Toronto’s Royal Bank Plaza in Toronto for €800M. Also alternative asset classes are playing an important role in many family office portfolios. Main target: private equity and venture capital investments. These are pursued either through funds or direct investments, sometimes as lead investor, sometimes as minority investor.

Based on a inhouse-developed keyword crawler, we also offer dedicated focus lists in the following verticals: Renewable Energy Single Family Offices | Fund Investor Single Family Offices | Hotel Investor Single Family Offices | Crypto Single Family Offices | Biotech Single Family Offices | SaaS Investor Single Family Offices

Extending our global family office database – and keeping it up-to-date

We have a multi-input process to find new entries for our global family office database. We rely on channels such as news analysis, investment-focused crawlers, our network of family offices and investment managers as well as in-depth people-based research. Although we use crawlers to find new family offices, all the entries in our family office database are created manually. Hence, we ensure high data quality and valuable information points for our customers. To keep our database up-to-date, we update it 1-2 times per year. For that, we rely on crawlers that tell us when family office details have changed. However, once again, the changes itself are realized by our team. Thereby, we ensure that we offer the best family office list available on the market.

What our international customers say about us

Swiss Citrus Holding AG

The well-researched database of «familyofficehub.io» helps us in communicating directly with other like-minded family offices. It allows us to exchange ideas about asset allocation and share experiences about brokers and advisors. In addition, the database permits the search for active and passive co-investment opportunities.

Wilhelm

A very helpful tool to detect the acquisition potential of a self-contained and demanding clientele. Great personal support. Continue that way.

Caroline

After using familyofficehub’s European database for a few months now, I can say with confidence that it is of strong quality (especially compared to competing US products) and that the team is constantly trying to expand it with relevant additional investors. I believe this is probably the best source of European family office data on the market today, which is a real achievement considering familyofficehub only launched at the beginning of the year. Do keep it up!

Luc

The “Top 50 Single Family Offices Switzerland”-list provides a very clear and current overview and saves long and time consuming researches. In addition to that I experienced a very uncomplicated and friendly service.

This is clearly the best list on Swiss Family Offices on the market. I can only recommend this product.

Eric Ranson

I purchased the U.S. real estate single family office database along with the U.S. Private Equity list, both have proved to be very useful and I am very impressed with the amount of data. Customer service was terrific, the team were very helpful and at my request provided me with insight into which lists were most suitable for my research.

CEO, Biotechnology Start-Up

The familyofficehub.io Team was very helpful in identifying and catering to our needs. The acquired lists were very helpful in the identification and pursuit of family offices for our Seed Round.

Richard Bottger

I have been an investment professional in the alternative asset space for 20 years with the last ten years as as a senior portfolio managers of a Global Absolute Return Fund. A great deal of time and effort is spent on uncovering discreet capital pools increasingly more often associated with family office environments where investment restrictions are minimized and where investors understand the nuances of patient capital for longer term capital appreciation. The familyofficehub.io provides a compelling product that is sufficiently detailed and accurately displayed. I will certainly do repeat business with the organization and applaud the offering.

Mateen

The data is provided with contact details of the leading Family offices in the Nordic region. It is helpful to plan to reach out to the investors with minimal effort.

FamilyOfficeHub has done an excellent job of updating the information on regular basis. The FamilyOfficeHub team is supportive with the post sales follow up and clarification.

Recommend for anyone with business interests in the Nordic region.

Matteo Marzagalli

I bought the list and I immediately found it very useful: easy to analyse and fast to check every record.

After two weeks of my purchase, I automatically received the updated version, that it is absolutely a must in this kind of service. I would definitely recommend it!

Lakshmi Viswanathan

Well curated list containing all details to connect relevant parties. The team from Family Office Hub is competent, professional and strives to bring additional value to their clients by providing meaningful industry insights

Picture source: Robert Bye

LDrechsler (verified owner) –

First, we acquired the renewable energy family office list. Since the quality was really good we now decided to also look for possible interested family office investors in the large global list. The download worked well immediately after the purchase. Data quality looks high like in the renewable single family office list. Sometimes missing email addresses but this is also communicated on the product page

Kreft Advisory, Zürich – Family Office Services and Corporate Finance –

Global, and a highly structured methodology perfectly aligns with our approach. The information is presented with the right precision, and with the right nuance in a fuzzy data environment. It is the best and most comprehensive list we have seen so far. The team of FamilyOfficeHub is motivated and helpful.