When private equity and venture capital firms start new funds, it is essential for them to acquire new investors. Usually, a large share of fund investments comes from existing investors. But especially when funds want to increase their assets under management or establish larger funds they need to get in touch with relevant investors. Single and multi family offices are especially relevant at this point. Why that’s the case and how to raise funds from family offices we will explain in this article.

Why Single and Multi Family Offices are important fund investors

Family offices differentiate from other investors like public pension and endowment funds, sovereign wealth funds or insurances. The teams are usually smaller, but the assets under management are huge. Every year, European single family offices and multi family offices invest billions of euros in private equity and venture capital funds.

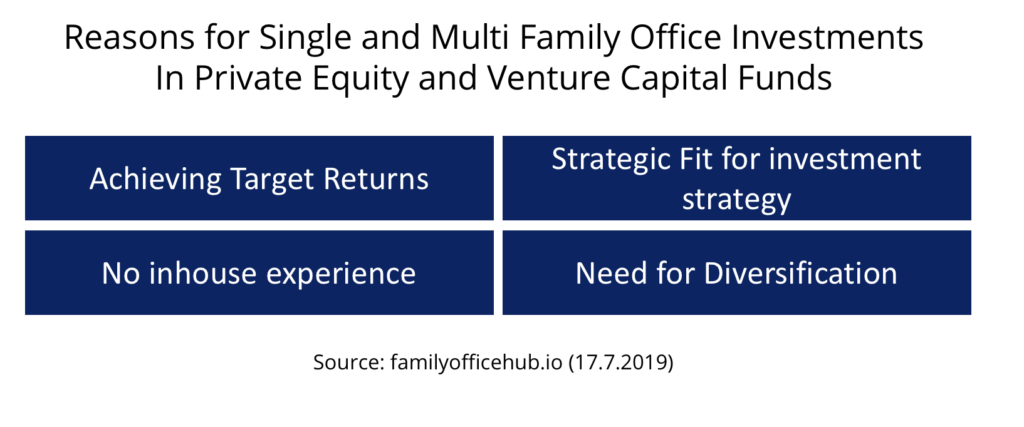

There are a few reasons why family offices are investing in funds (instead of direct investments). First of all, family offices often have targeted yearly returns. Achieving them is especially in times of low interest rate a hard task – and successful PE and VC funds can help to bring in the required return component into the portfolio. Furthermore, through the various investments of PE and VC funds a higher degree of diversification is granted. Often, family offices also diversify their private equity fund portfolio by investing in different sectors and regions. Also certain funds are a strategic fit for the family office portfolio. For instance, a SFO of a former tech entrepreneur with a heavy focus on software investments tends to invest in a software-focused VC or PE fund. In many cases, for smaller family offices (<100M€ assets under management) it is too expensive to build up inhouse experience in PE and VC investments – so they rely on funds instead.

Best Practices: Approaching Family Offices to raise funds

We want to be honest from the beginning: raising funds from family offices is not an easy task. As investors, family offices are reliable partners which can invest huge amounts. On the other hand, they are in most cases really discrete and cautious when people get in touch with them. That makes the approach for fundraising especially difficult. Fortunately, we can give you some “best practice” guidelines, how the approach of single and multi family offices can work:

- Compile a list: First of all, you have to compile a list of relevant single and multi family offices. Alternatively, you can rely on our extensive lists of European single and multi family offices. We conducted our lists through our extensive network, years of thorough research and modern technologies. Best fits are SFOs and MFOs that have previously invested in VCs and PEs.

- Avoid mass mailings: It is tempting to use the compiled list for a huge mass mailing. Alone with our lists, you would be able to get in touch with more than 800 family offices. But we strongly advise you to work on individual approaches instead of mass mailings.

- Compile background information: Before you approach a certain SFO or MFO, compile background information and try to find similarities to your own firm. Are VC or PE investments fitting their investment philosophy? Have they relevant exemplary investments? Et cetera. The information will help you for the optimal approach. “We saw that you invested in XYZ – which is also a portfolio company of ous – and we thought it might be interesting to talk” works always better than “Hi, we are XYZ investors and we are currently establishing a new fund”.

- Work on personal introductions: Some family offices exclusively work with personally introduced or known firms. That makes personal introductions especially valuable. Try to find connections, for instance through LinkedIn. That won’t work for every family office, but it’s worth a try.

- Great approaches: When getting in touch with family offices for the first time, work on outstanding mails or calls. Try to be special, refer to the certain family office, if you write a letter sign it personally. Especially important: Avoid any spelling and grammar mistakes.

- Host events: Also always a good way to get in touch with family offices is to host events in your area and invite relevant single and multi family offices. That takes a lot of effort, but a convinced family office will make it worth. For example, some venture capital funds host yearly exclusive events with their LPs, prospective investors and portfolio companies.

- Be courteous and polite: Family offices attach great importance to good manners and extraordinary service.

Summing it up: approaching family offices takes time and comes with a large effort. It is important to go the extra mile and to offer good products (funds) and extraordinary service. Preparation is essential, mass mails are pointless.

Leveraging your fundraising process through our European family office database

As mentioned before, it is crucial to have a solid database of potential single and multi family offices. The database can be compiled through your research team in a yearlong process. Or, instead, you could rely on our extensive database of relevant SFOs and MFOs. Leading private equity and venture capital funds from countries all over the world rely on our services. The databases can be acquired and directly downloaded with only a few clicks. We introduce you to our two bestseller lists.

-

Rated 5.00 out of 5€899,99 including VAT

-

Rated 4.63 out of 5€999,99 including VAT

HQ Capital Case Study: German Multi Family Office investing in private equity funds

An interesting example for the private equity strategy of a family office is the German firm HQ Capital. In the beginning, HQ Capital was the single family office of family members of the German Quandt family. Just a few years after the foundation, HQ turned to a multi family office. Today, the firm is managing more than €10B. HQ is heavily investing in private equity through different vehicles. In total, the company invested in 481 different private equity fonds from 234 different fund managers. The family office employs 89 professionals in offices in Frankfurt, New York, Shanghai, London, Hong Kong, Seoul and Tokyo. Besides that, the family office is also directly investing through its own firm HQ Equita. HQ Capital is also acting as co-investor in leveraged buyouts and recapitalizations and in secondary transactions.

This article is part of our Family Office Knowledge, Analyses and Statistics section.

Picture source: Ali Lokhandwala