Since the beginning of this year, the world is confronted with a pandemic crisis of unprecedented proportions. Due to the Coronavirus, several countries are on lockdown, stock markets are tumbling and companies are going bankrupt. But how are family offices reacting – whose main task is to preserve the fortune of the world’s wealthiest families? Last week, we talked to 15 relevant single and multi family offices from Europe and the United States and asked them how they react on the COVID-19 crisis. We are excited to publish the world’s first study about the reaction of family offices on the Coronavirus. The exclusive familyofficehub.io study aims to give guidance for family offices and investment firms how to react best in these stormy times. 53,3% of the participants were executives from major multi family offices, 46,7% were single family office executives.

Note to media outlets, blogs and others who are interested in using graphs and information from our study: Feel free to use our graphs and results, but please don’t edit them and properly give credits to familyofficehub.io. We would be also happy if you drop us a line to contact [at] familyofficehub.io and tell us where you used our results.

Key takeaways from our study: How do family offices react to the Coronavirus crisis?

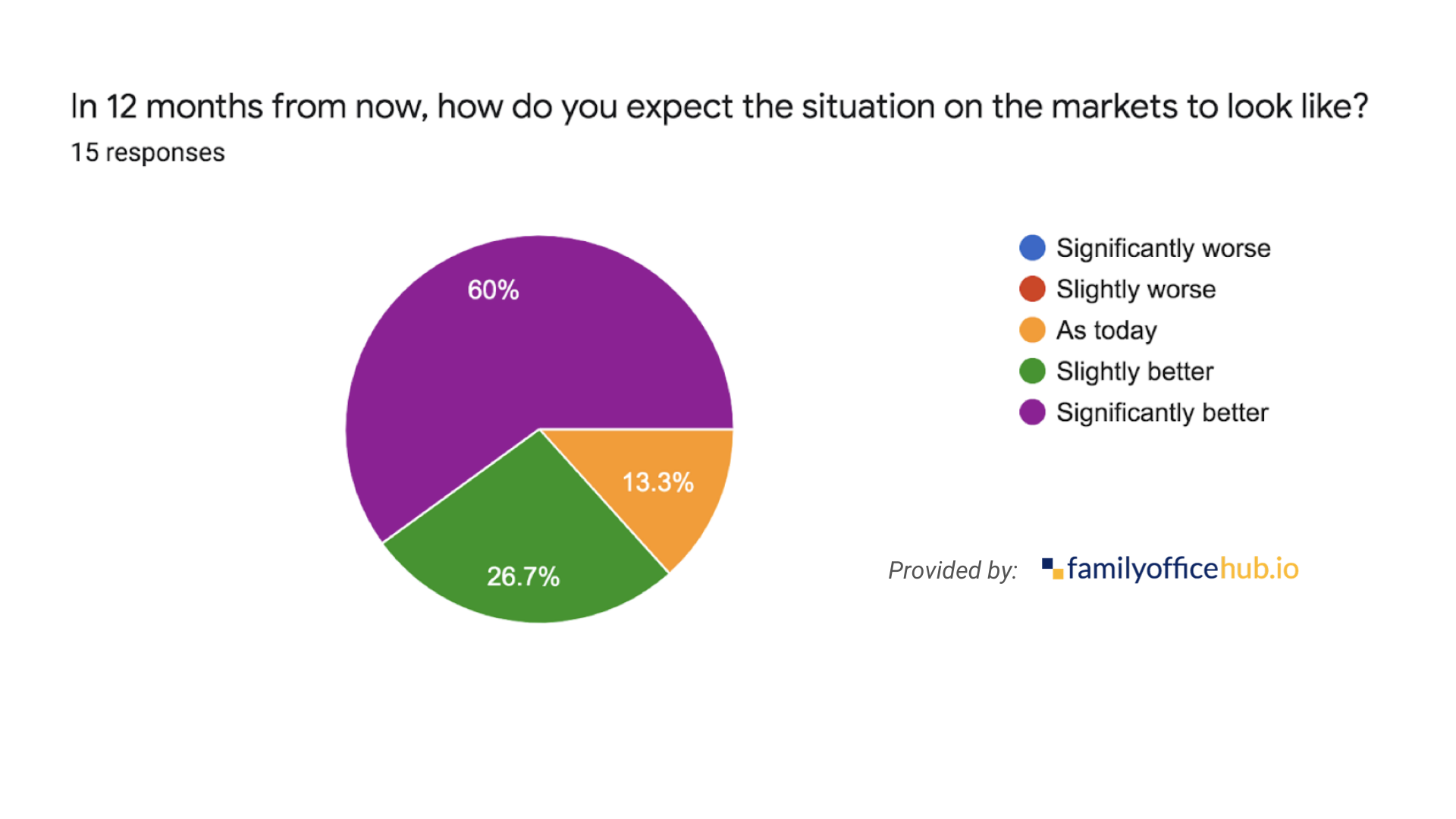

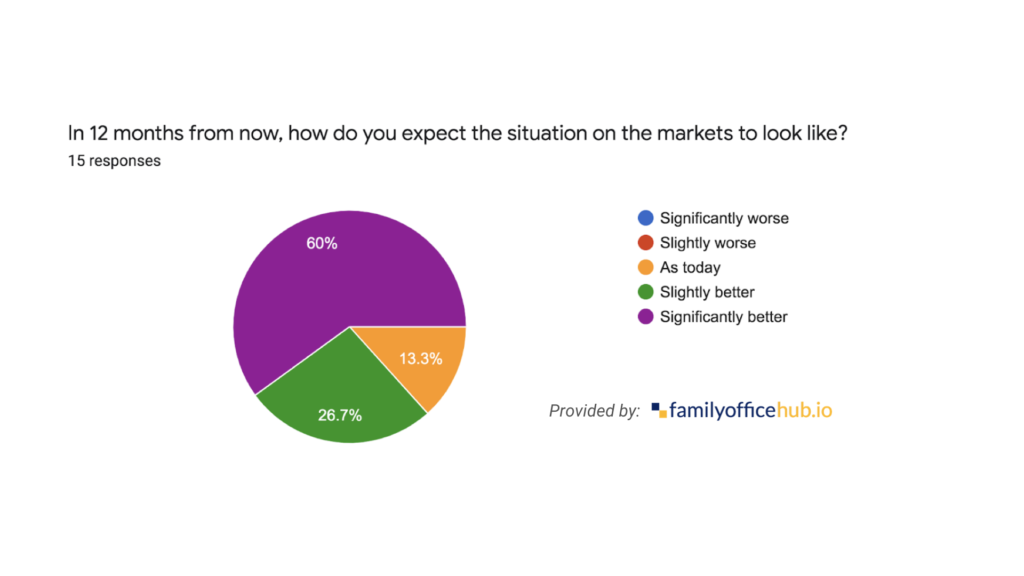

- Most family offices look optimistically into the future: 60% of family offices believe in a significantly better situation (on financial markets) in 12 months and 66,7% believe in a slightly better situation in 6 months. Only 20% think that the markets will look slightly worse in 6 months.

- All family offices are exemplary in terms of home office: 46,7% of family office teams are completely working from home, 53,3% are working partly from home office. There are no family offices which haven’t introduced home office yet.

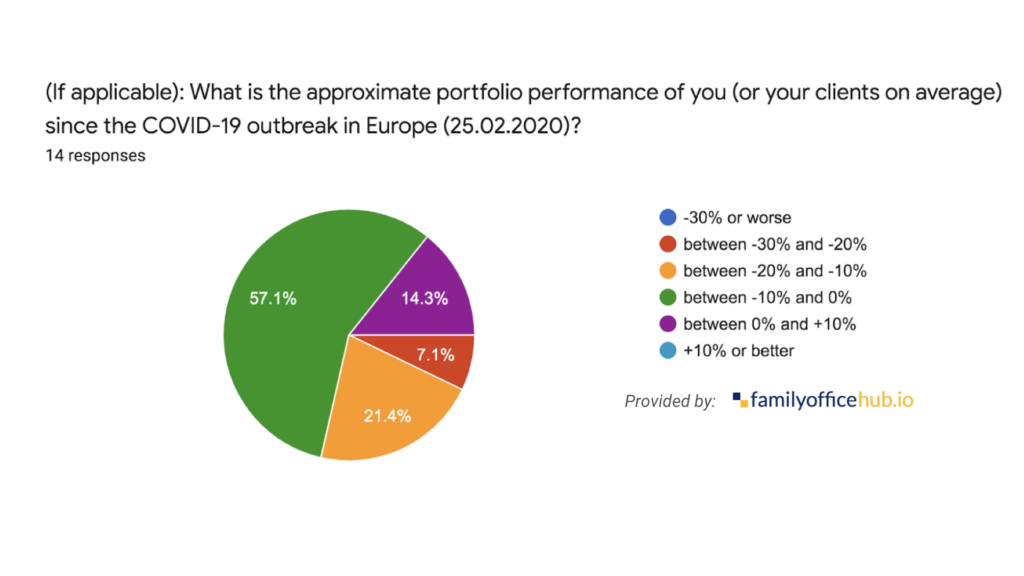

- Most family offices only experienced slight portfolio losses: 57,1% of family offices had portfolio losses between -10% and 0% since the 25th of February.

- Family offices see various investment opportunities through the Coronavirus: from food and tech stocks to distressed corporate bonds

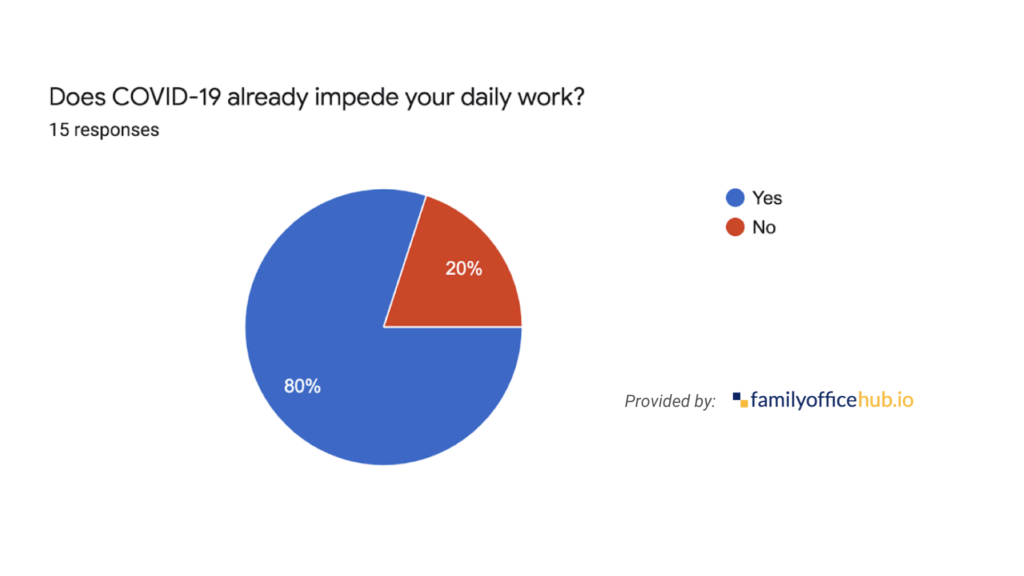

Worklife at family offices: Coronavirus is impeding daily operations

In general, the worklife of family offices is (understandably) disturbed through COVID-19: 80% of family offices from our study state that their daily work is impeded by the pandemic. The tension is high: the family wealth and portfolios have to be protected, the priorities of families are changing. While some months ago some families might have decided to explore riskier asset classes like private equity, now risk management and wealth preservation is the top priority. Furthermore, various deals were canceled due to the high uncertainty in the market.

The surveyed family offices are quite active when it comes to measures against the COVID-19 spread: 46,7% of family office teams are completely working from home, the remaining 53,3% are working partly from home office. Hygienic standards are increased, governmental guidelines are strictly followed, additional company internal policies are created.

Family office investments and performance in times of COVID-19

In general, most family offices portfolios performed quite well during the last weeks: 57,1% had losses between -10% and 0% since the 25th of February. 14,3% of surveyed family investment firms even managed to reach a performance between 0-10%.

The surveyed family offices reached their quite good performance through various measures, amongst others:

- Derivatives

- Uncorrelated strategies

- Diversification

- Strict risk management and stop losses

Measures to protect the family office wealth in times of Corona

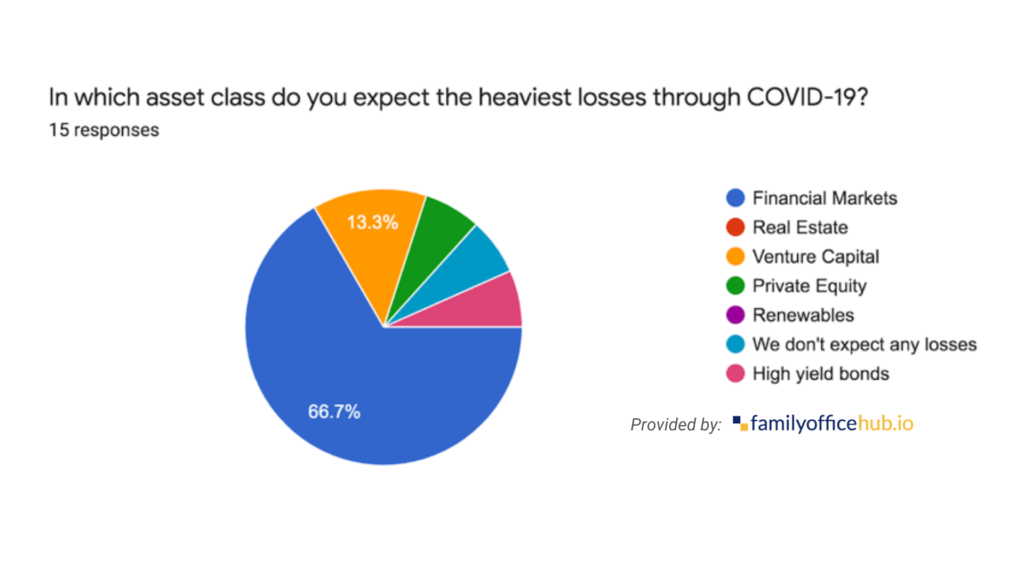

Family offices expect the worst consequences on financial markets. Besides that, some family offices also expect their heaviest losses in venture capital investments. Interestingly, only 20% of surveyed family offices have changed their investment style due to the crisis and 26,7% is considering changes tot heir investment strategy. The remaining 53,3% decided to remain calm and to stick on their investment style.

In order to protect the family wealth, the surveyed family offices undertook various measures. Amongst others, equity holdings are supported through equity cushions and strategic support. Other family offices are already aggressively preparing for purchases. Many family offices target tech and food stocks. A special focus is on FANG stocks (Facebook, Apple, Netflix, Google) who also experienced heavy losses. The complete list of all measures undertaken is only provided to the family offices who participated in the study.

Family offices are optimistic: 66,7% expect a slightly better situation in 6 months,

Finally, we asked the participating family offices on their opinion about how the markets will look like in 12 months. Despite the current uncertain situation, momentary losses and impeded operations, most of the family offices are looking optimistically into the future. 60% of surveyed family offices are expecting a significantly better situation on the markets in 12 months, 26,7% expect a slightly better situation. Only 13,3% think that the situation will be the same as today in 12 months. In 6 months, 66,7% of family offices expect a slightly better situation.

Nevertheless, the upcoming months will be intense for international family offices. The family wealth has to be preserved, operations have to be maintained under difficult conditions, equity holdings have to be supported and opportunities in markets have to be seized.

With this in mind: stay safe and healthy! If you or your family office is interested in talking to us about the corona crisis or your measures undertaken, we are looking forward to your email to contact [at] familyofficehub.io.

Be the best informed family office insider in the room: don’t miss to sign up for our free monthly family office newsletter. We are reporting about the latest investments of family offices, newly founded family offices and the most important industry happenings. Already +1000 investment professionals have subscribed to our newsletter. Join now!

Get in touch with the world’s most important single and multi family offices

-

Rated 5.00 out of 5€699,99 including VAT

-

€4,99 including VAT

-

Rated 5.00 out of 5€899,99 including VAT

-

Rated 4.63 out of 5€999,99 including VAT